Dear our respectful Risun's shareholders,

The exceptionally difficult year of 2022 has passed. It ended not only a meaningful year, but also ended the century pandemic, which caused people in the world suffering an extraordinarily difficult times for the past three years. Geopolitical rift, increasing regional conflicts and various prominent conflicts and crises, these makes people difficult to accept and hit emerging economies of all countries hardest as well as all enterprises around the world. Furthermore, all enterprises are severely impacted by both the rapid change of global energy landscape together with surging raw materials prices. Under this rapid changing environment, Risun not only operates its business stably and healthy, but also achieves a rapid growth in business.

Within this annual letter to Risun's shareholders, I would like to illustrate how we have gone through this three-years pandemic, how we overcame such impact and resolved the surging raw materials prices in order to result in precious profit. Also, how we grew rapidly without undermining our bottom line in safety. Through internal investment and external mergers and acquisitions, we emerge out of Hebei Province – our place of origin for many years and expand Risun's business by covering the national layout at preliminary stage.

1. Results of Risun in 2022

Since its listing in 2019, Risun has focused on the upstream and downstream of the industry, expanded its domestic and overseas layout, and consolidated the leading position of coke, extending from basic refined chemicals to the industrial chain of new materials and new energy, achieving the continuous growth of the Company's overall scale and revenue.

In 2022, coke production volume was 9,214.5 thousand tonnes and respective revenue was RMB16,368 million, representing an increase of 16.71% and 89.86% as compared to 7,895.4 thousand tonnes and of RMB8,621 million in 2019 respectively;

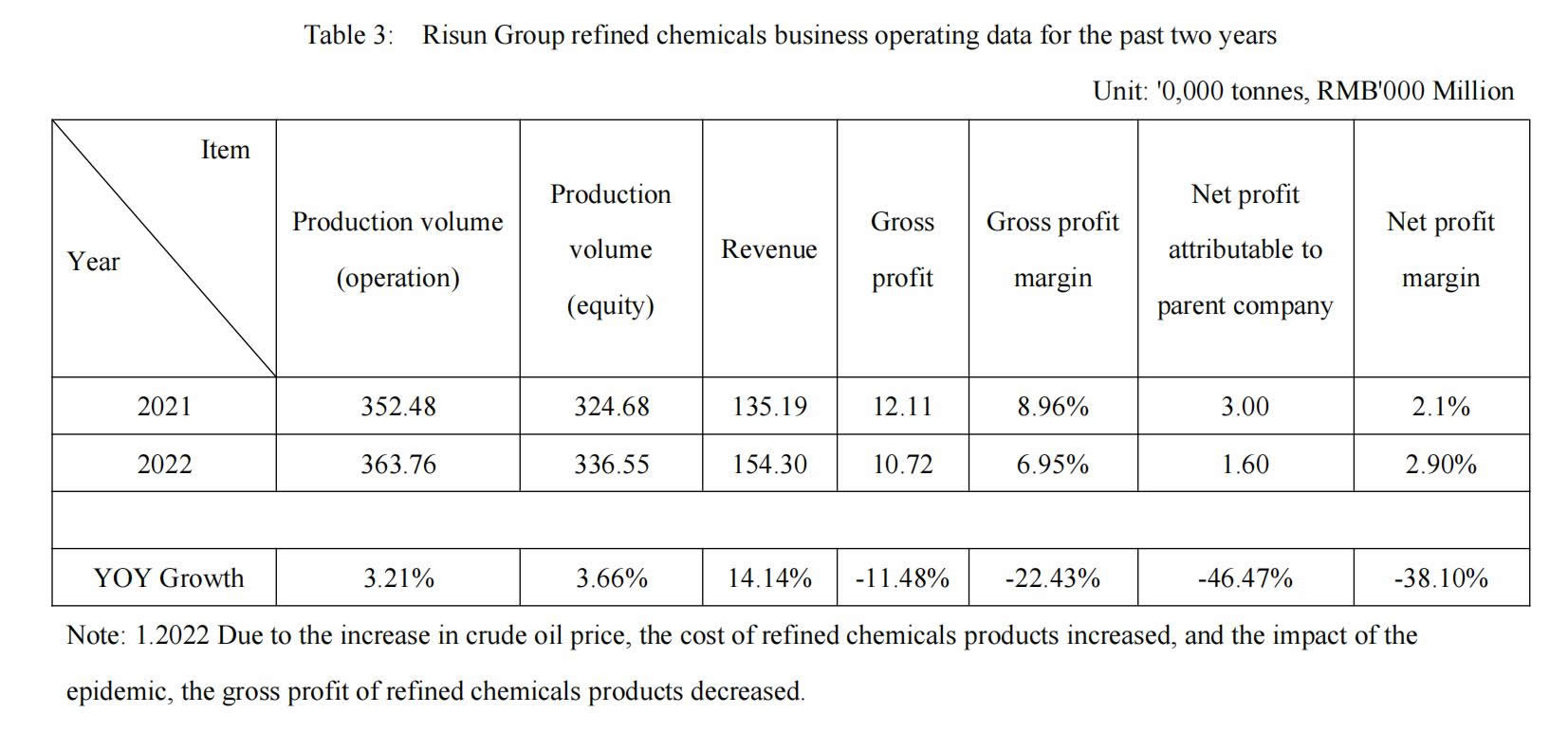

In 2022, production volume of refined chemicals was 3,637.6 thousand tonnes and respective revenue was RMB15,430 million representing an increase of 83.13% and 115.62%, as compared to 1,986.3 thousand tonnes and RMB7,156 million in 2019 respectively;

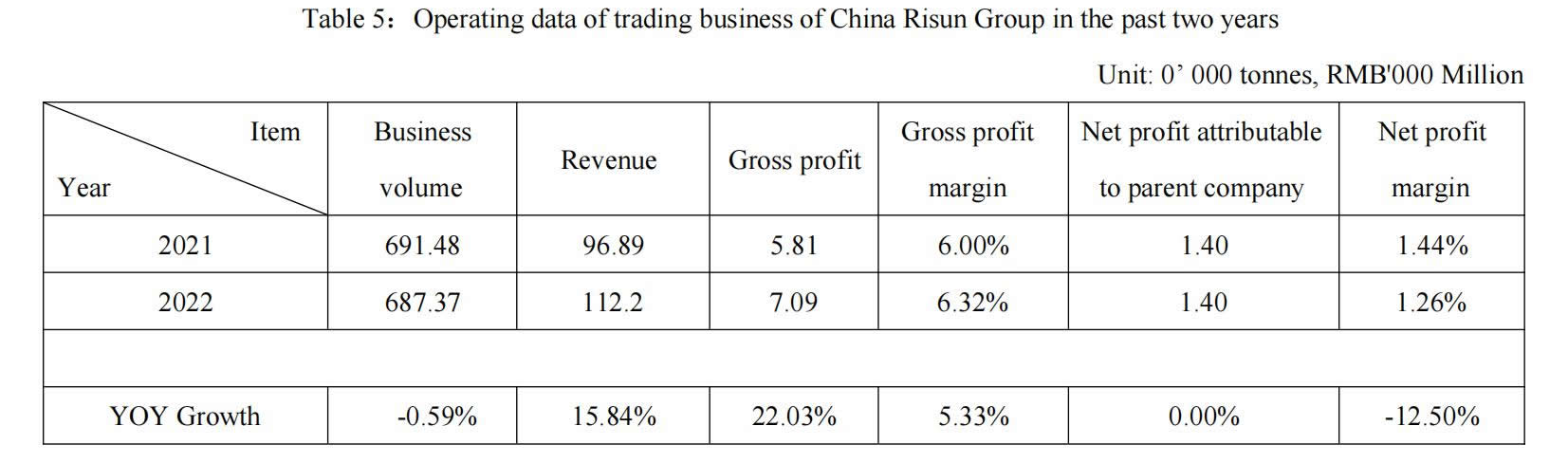

Trading business volume of 6,873.7 thousand tonnes and respective revenue of RMB11,224 million in 2022, representing an increase of 59.72% and 452.36%, as compared to 4,303.6 thousand tonnes and RMB2,032 million in 2019 respectively;

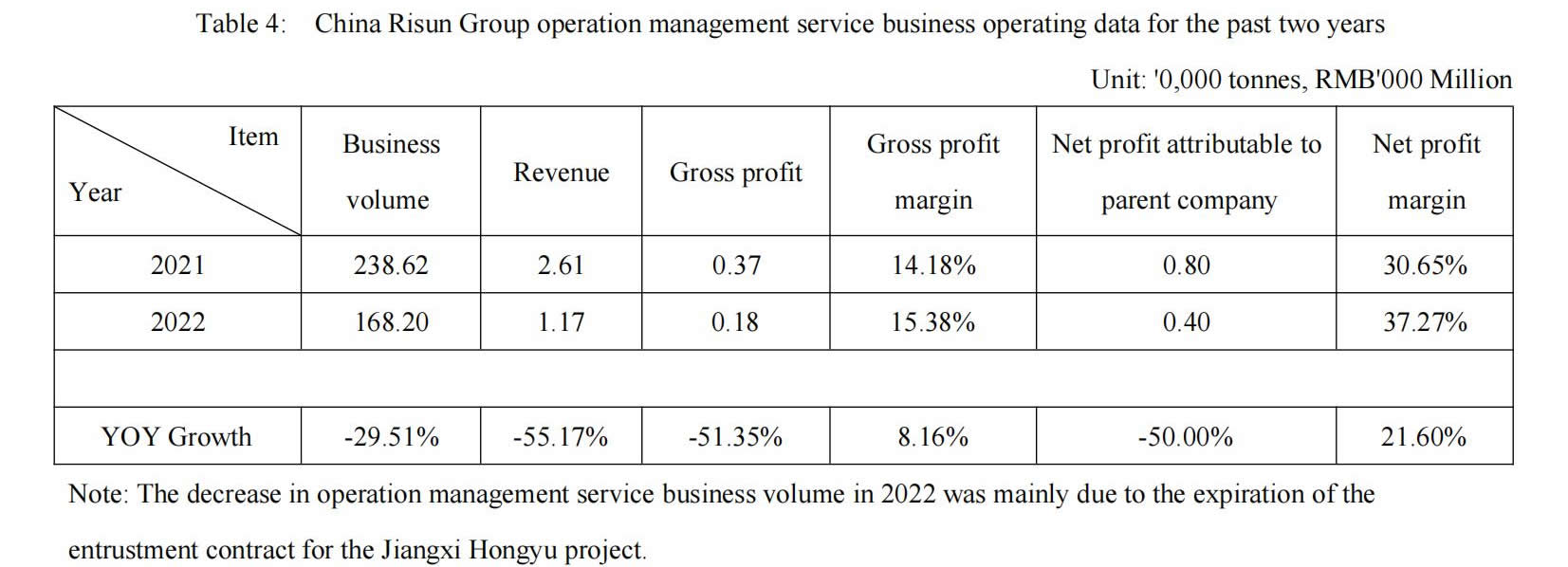

Operation management services business volume of 1,682 thousand tonnes in 2022 and respective revenue of RMB117 million. From 2019 to 2022, the aggregate operation management services business volume is 9,064.7 thousand tonnes and respective revenue is RMB2,013 million.

1.1 Composition of the business of Risun

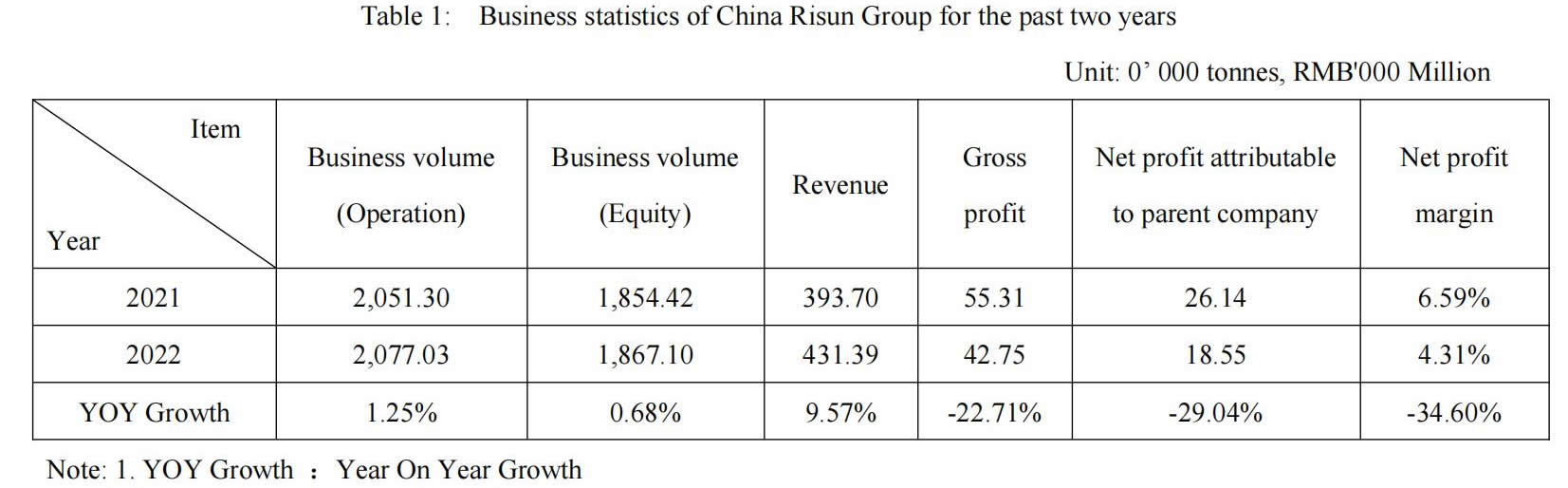

(1) Steady growth in 2022

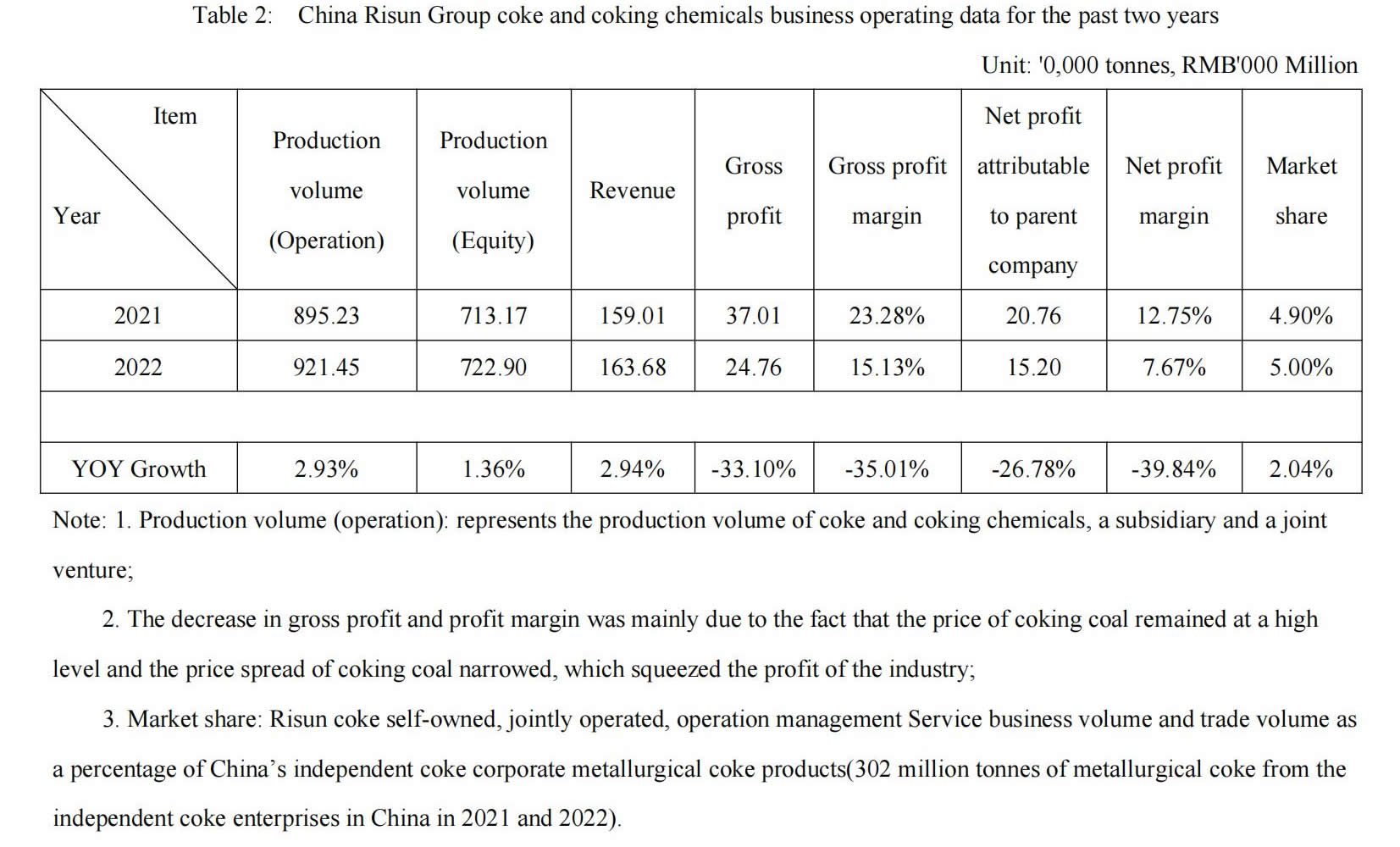

(2) Coke industry surplus is stable, market share in steady progress

(3) Refined chemicals production volume increased rapidly and revenue reached a new high

(4) Operation management Service was efficient and net profit margin increased steadily

(5) Stable development of trading business with continuous growth in profit

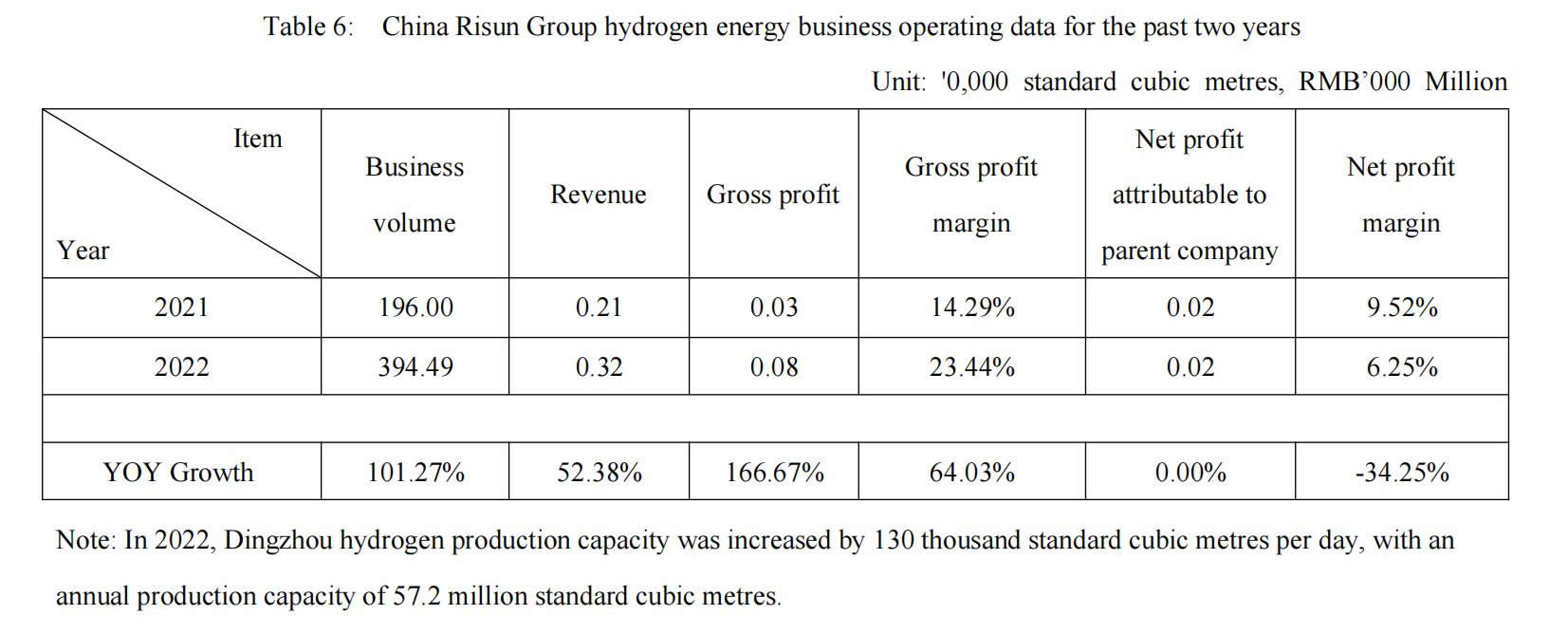

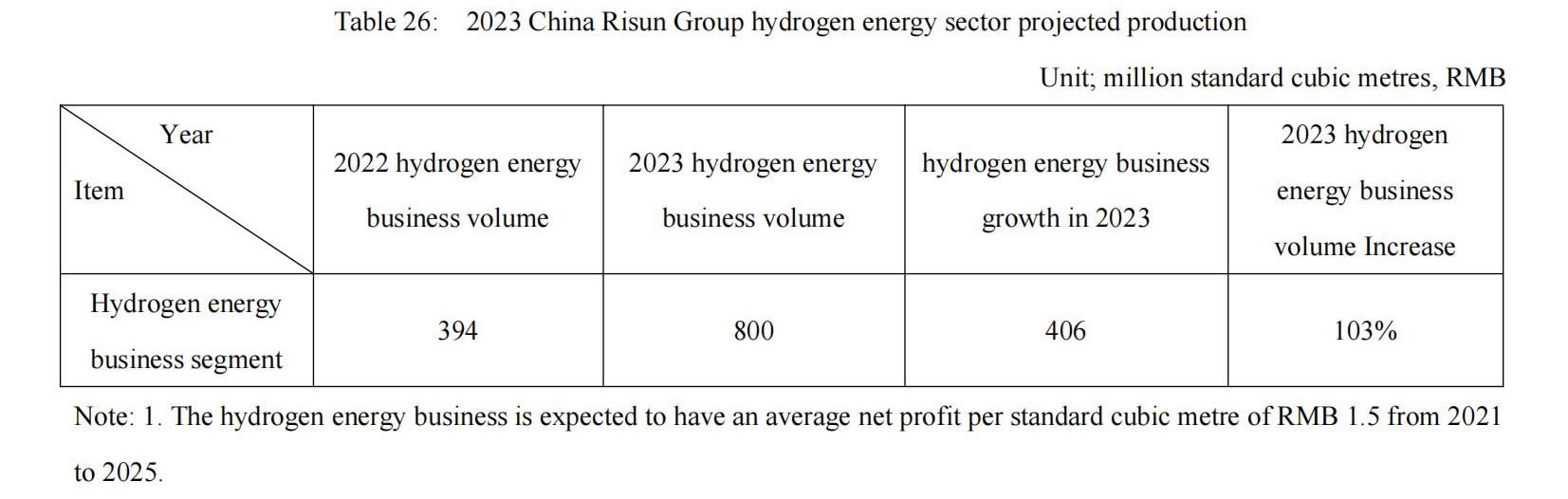

(6) Hydrogen energy business expanded rapidly and gross profit increased significantly

2. Comparison between the same industry

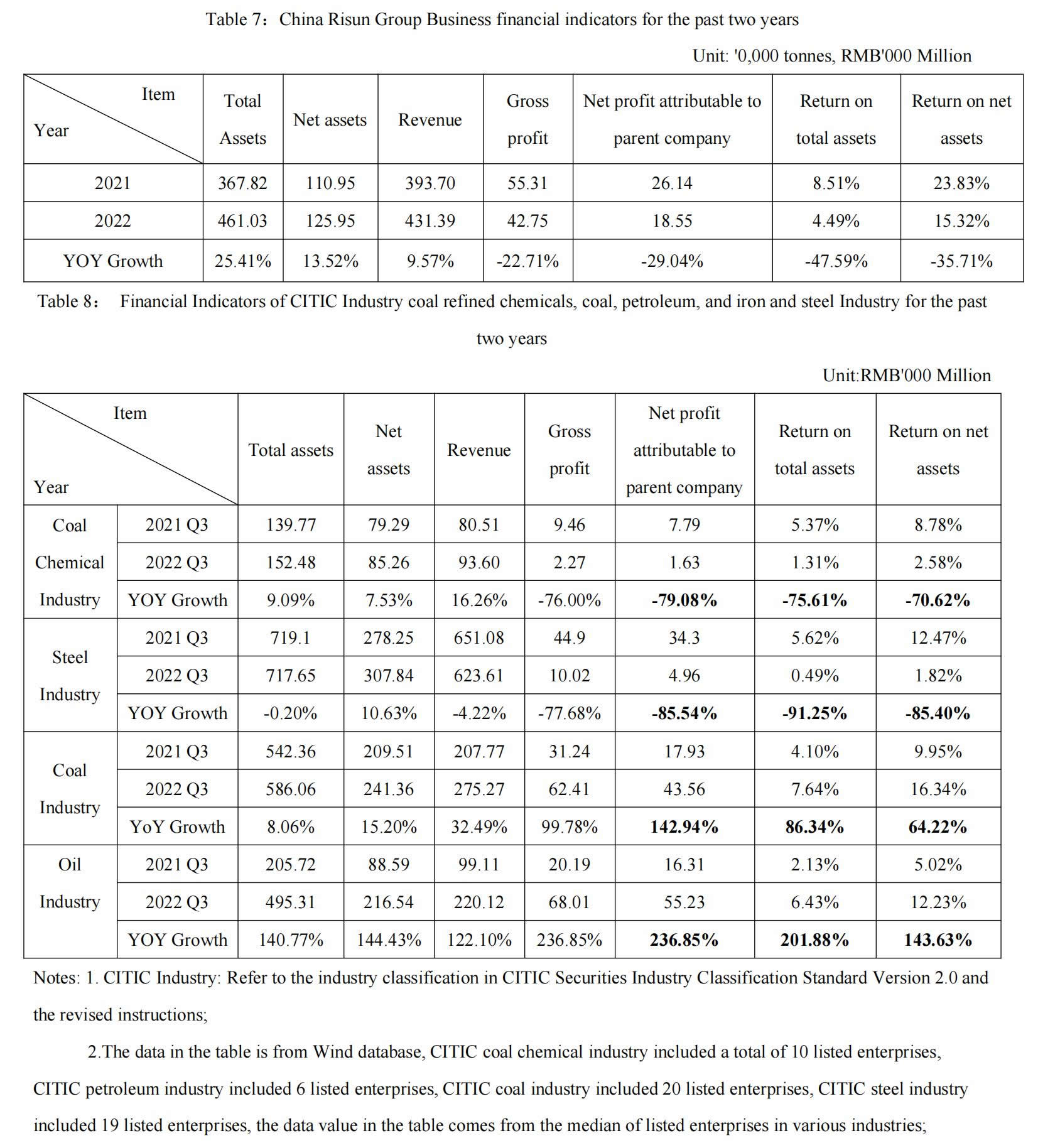

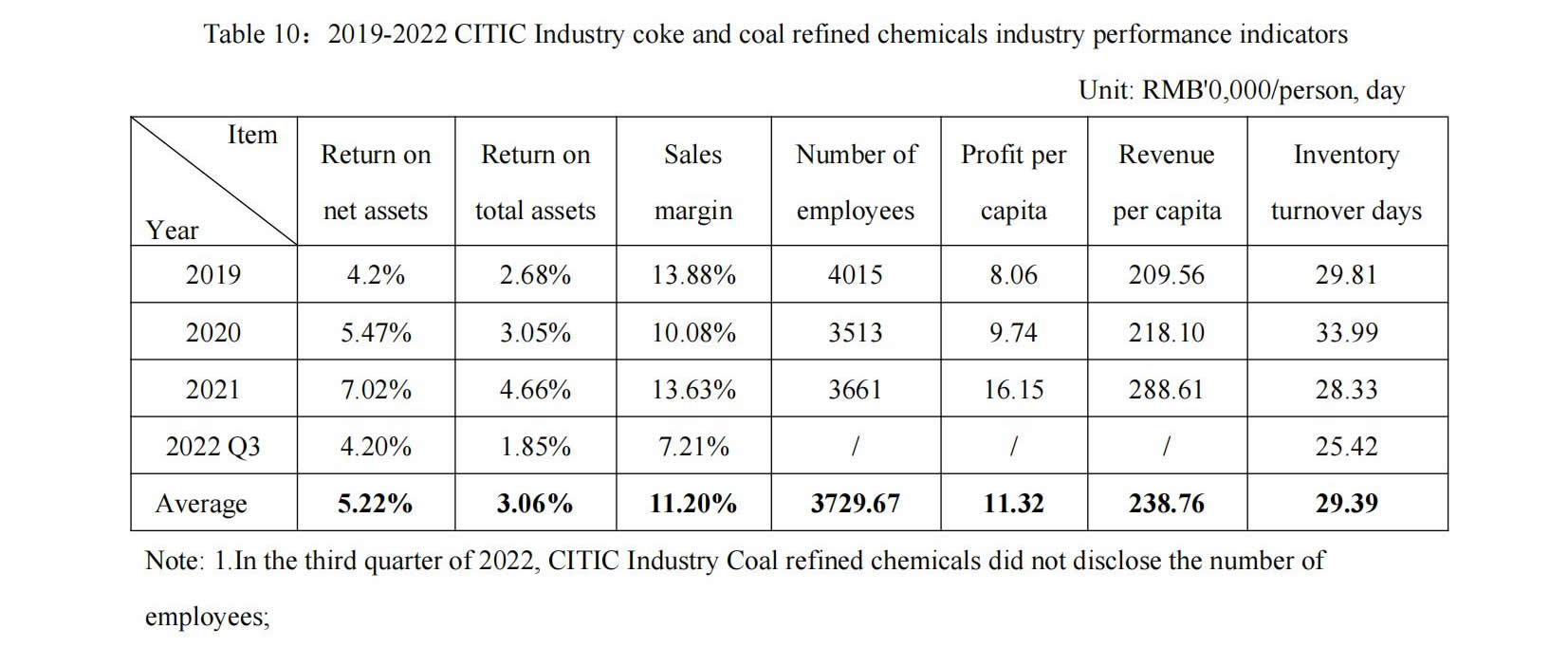

In 2022, Risun made use of its nine core competitive advantages, including scale advantages, vertically integrated advantages, production base advantages, cost control advantages, centralized sale and marketing advantages, innovation advantages, automation and information technologies advantages, environmental and safety advantages, and risk mitigation advantages, in the external complex and severe market environment. In the industry downward cycle, we still achieved a net profit attributable to the parent company of RMB1,855 million, total assets of RMB46,103 million and revenue of more than RMB43,000 million. The production volume of our coke and refined chemicals continued to increase. Compared with the coal chemicals industry in the third quarter of 2022, the net profit of the industry decreased by 79.08%, higher than 50.06% over the industry; the return on total assets of the industry decreased by 75.61% year-on-year, we were 28.02% higher than the industry; the return on net assets decreased by 70.62% year-on-year, we were 34.93% higher than the industry. Risun delivered a satisfactory year-on-year result.

3. Capital Market Performance

In 2022, the unexpected changes in the domestic and international economic environment triggered significant volatility in the capital market. During the downward cycle of the coke and coal refined chemicals industries, Risun demonstrated strong development resilience and stable market performance.

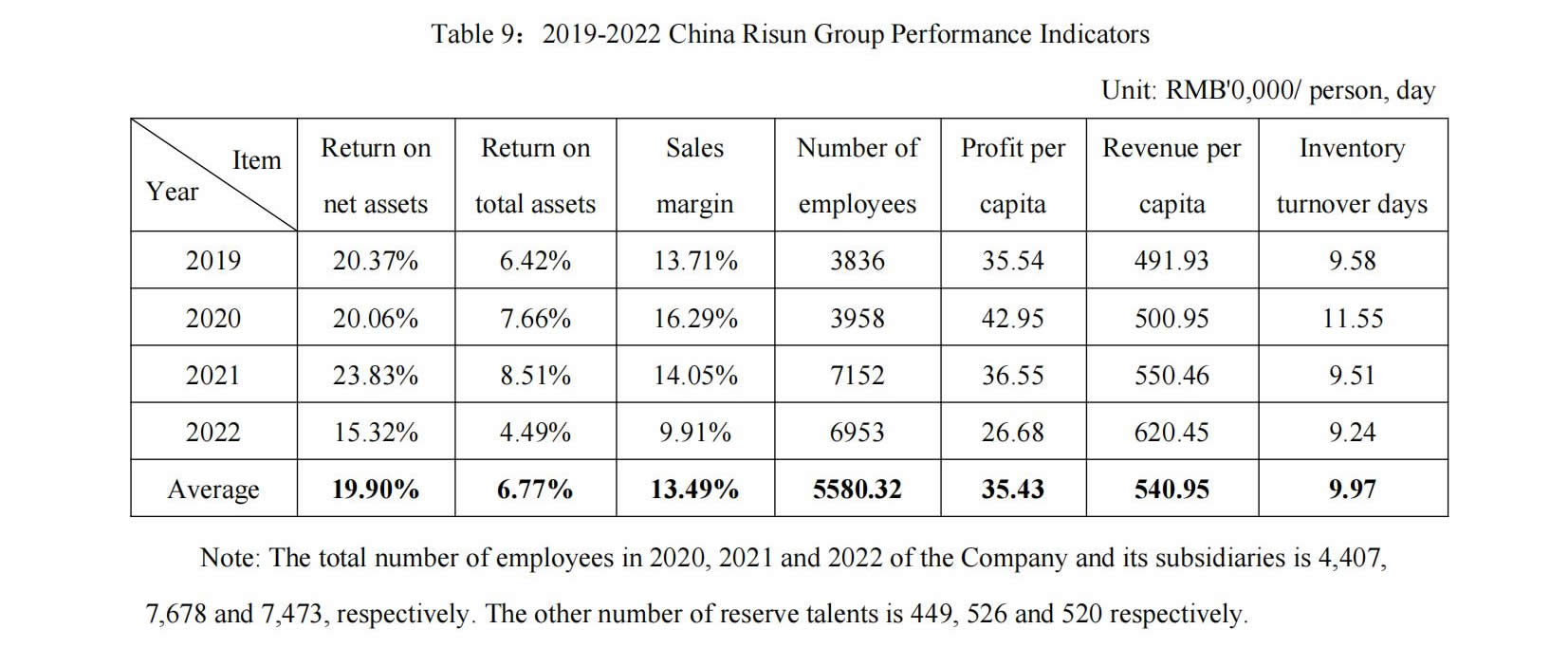

(1) Industry advantages of Risun

Risun has been deeply engaged in the coke and refined chemicals industries for twenty-eight years, investment efficiency and capacity utilization rate reached the industry leading level. We have realized the full production under the premise of safety, environmental protection and quality, realized the high efficiency and stable utilization rate of fixed assets and current assets. The return on net assets and return on total assets have been higher than the industry for a long time. From 2019 to 2022, the return on average net assets of the Risun was 19.90%, and the return on average net assets of the industry was 5.22%. We were 14.68% higher than the industry, representing 3.8 times of the industry; From 2019 to 2022, the return on average total assets of Risun was 6.77% and the return on average total assets of industry was 3.06%, which was 3.71% higher than the industry and 2.21 times of the industry. At the same time, we have formed nine core competitive advantages and a management system integrating sales, transportation, production and supply, which are reflected in the following three aspects:

Firstly, in terms of sales, transportation, production and supply:

① We achieved excess earnings of RMB50-70/tonne higher than the industry by adhering to the principle of full sales advance receipt, cash settlement and daily revenue accounting within 15 days in advance;

② We adhered to the zero-inventory strategy and achieved far higher inventory turnover days than the industry. From 2019 to 2022, our average inventory turnover days were 9.97 days, and the average inventory turnover days of industry were 29.39 days. Our inventory turnover speed was more than 3 times that of the industry, which was 19.42 days higher than the industry;

③ We worked closely with upstream and downstream supply chains, with strategic customers accounting for 70%. Also we steadily with strategic customers and decades of cooperation;

④ We owned 100% of the train transportation and loading and unloading capacity, and improves the on-site turnover efficiency by increasing the proportion of coal transportation by over 80%. At the same time, we reached strategic cooperation with the railway bureau to improve the settlement efficiency, saving transportation costs of RMB30-50 per tonne compared with the industry average level;

⑤ We worked with the large mine manager by the strategic cooperation, accounts for more than 65% of the total coal mines, improving the extension of the industrial chain, launching supply chain finance, and reducing cost, and reduce the cost RMB50-100/tonne;

Risun achieved industry-leading gross profit margin by virtue of its advantages in sales, transportation, production and supply. From 2019 to 2022, our average sales gross profit margin was 13.49%, the industry average sales gross profit margin was 11.20%, we were 2.24% higher than the industry and 1.2 times that of the industry.

Secondly, production technology and research and development:

① We achieved a production cost saving of RMB80-120/tonne over the industry average level by precise coal blending, circular economy, complete supporting facilities and 65% of self-supplied electricity;

② We established 5 professional research institutes, owned 8 high-tech enterprises, 424 patented technologies and 236 patents, achieved technological efficiency improvement of RMB30/tonne, and achieved annual tax savings of RMB300 million;

③ We have set up a master and doctoral degree talent team, with a total of 407 existing technical R & D personnel, accounting for 3.57% of the total, including 22 doctors, accounting for 5.41% of the total, and 127 masters, accounting for 31.20% of the total, continuously driving our per capita profit and per capita income. From 2019 to 2022, our average profit per capita was RMB354,300/person, the average profit per capital of the industry was RMB 113,300/person, which was higher than the industry of RMB241,000/person, representing 3.13 times of that of the industry. From 2019 to 2022, our average income per capital was RMB5,409,500/person, the average income per capital of the industry was RMB2,387,600/person, higher than the industry of RMB3,021,900/person, representing 2.27 times that of the industry.

Thirdly, informatization and automation:

①We owned 176 informatization engineers and 14 computer software intellectual property rights, which enables real-time collection of production data and monitoring of the operation of production equipment with automatic equipment and automatic control system. The automatic control rate of all devices is over 98%, and the automatic control rate of coke and coking chemicals devices is 100%;

②We focused on the four main lines of safety and environmental protection, production management and control, material supply, and the whole life cycle of factories to create intelligent application scenarios to improve efficiency. It has successively won more than 10 industrial Internet and informatization leading enterprises honors such as the information security pilot enterprise of industrial control system, the leading enterprise of informatization transformation, and the China Intelligent Management Outstanding Application Award.

Risun has achieved an efficient and stable operation model by leveraging its nine competitive advantages and the integrated management system of sales, transportation, production and supply. The return on net assets, return on total assets and gross profit margin of sales have reached the industry-leading level. The introduction of talents and reserve have accelerated the transformation and development, and have demonstrated the comprehensive ability to cross the cycle and continuously make profits.

(2) Capital Market Performance of Risun

The past year was a year of significant volatility in the capital market, as well as a year of preparation for Risun in the capital market. Although there is a short-term downward adjustment in the market value in 2022, we are pleased that under this situation, the Company's development prospects and long-term investment value are still recognized by investors. Over the past four years since its listing, the Company's industry advantages have become increasingly prominent, and the performance of the capital market has also increased steadily, which is reflected in the following three aspects:

Firstly, in terms of stock price market value indicators and company ratings:

①Compared with the beginning of listing, the stock price of the company achieved an increase of 61.79% according to the subsequent recovery rights, reaching HK$4.53 per share, and HK$3.58 per share, an increase of 27.86% (the closing price of the stock on March 31, 2023 was compared with HK$2.8 of the offer price on March 15, 2019).

②Compared with the beginning of listing, the market value of the company also increased significantly, up by 41.07%, exceeding HK$15,800 million; P/E increased from 4.8x to 7.6x, an increase of 36.84%. In the past four years, the capital market has continued to fluctuate. From March 15, 2019 to March 31, 2023, the Hang Seng Index continued to decline, falling byabout30%. The market value of the company bucked the trend, rising by 31.79%, significantly better than the Hang Seng Index, highlighting the long-term investment value;

③We have conducted more than 1,300 road shows with 1,010 institutions, and many analysts from domestic and overseas securities firms have issued a number of research reports, all of which gave China Risun a "buy" or "increase" rating, and investors responded positively. As of March 31, 2023, public shares accounted for 29.4% of the total share capital.

④We showed excellent performance and capital market performance, and has been listed in the Fortune China 500 for the fourth consecutive year, ranked 322nd in 2022, 82nd ahead of the best ranking in history.

⑤In 2022, we were adjusted from small-cap to medium-cap by Hang Seng Indexes Company Limited, and was included in 15 Hang Seng Series indexes including Hang Seng Large-Mid Cap Investable Index. After being included in Shenzhen-Hong Kong Stock Connect in 2019, the Company was included in Shanghai-Hong Kong Stock Connect last year. As at 31 March, 2023, the total number of shares held through Southbound Trading has reached219 million shares, representing a market capitalization of HK$784 million, representing an increase of approximately54.75 times as compared with 4 million shares held through Southbound Trading as at December 31, 2019.

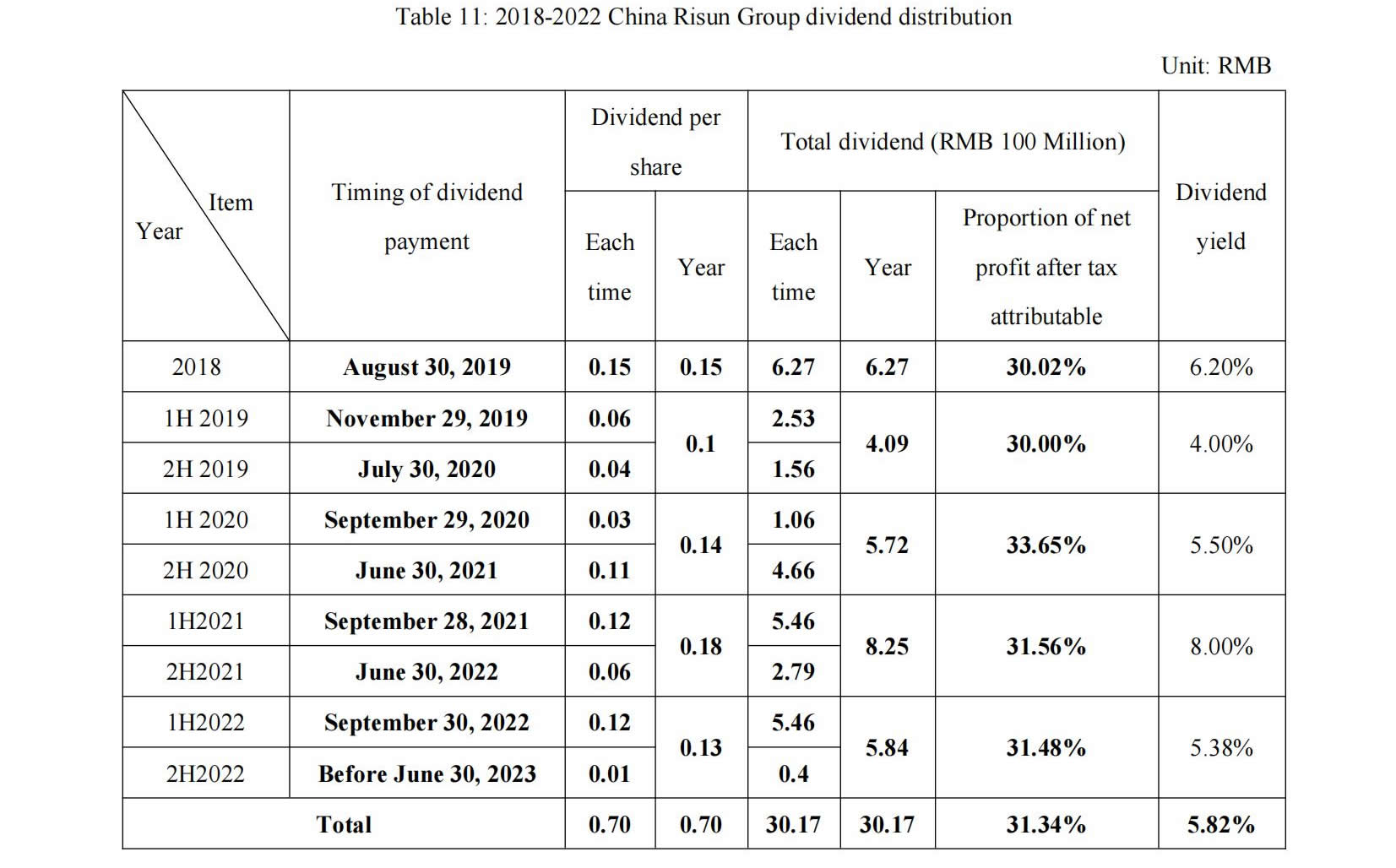

Secondly, the dividend distribution of Risun:

We have realized the commitment of no less than 30% of the net profit to the investors at the beginning of the listing, and the average dividend profit accounted for 31.34%. In the past four years of listing, we have distributed dividends for nine times to investors, with a total amount of RMB3,017 million and an average dividend rate of 5.82%.

Thirdly, in terms of repurchase by the Company and increase in shareholding by substantial shareholders:

The major shareholders, directors and management of Risun also firmly believe that the downward adjustment of share price and market value is temporary. We have successively repurchased and increased our shares. Also we repurchased 15,874,000 shares in total and the major shareholders increased their shareholding by 8,404,000 shares in total.

With the recovery of the economy and the recovery of the capital market, Risun, which is superior to the development prospects of the industry, will certainly usher in a new round of growth in the capital market. In 2023, we will continue to strengthen the repurchase, and major shareholders will also increase their holdings to stabilize capital market expectations. In the future, we are expected to increase the coverage of overseas securities companies, strive to obtain investment in the global capital market, and further consolidate the pace of global expansion. At the same time, we will actively communicate with large indexes such as MSCI, and is expected to be included in more indexes and obtain more shares of large funds. Also we will split and list the sectors with capitalization ability at appropriate times, improve the asset valuation, promote the performance of the company's capital market, and create favorable conditions for the long-term development of the company.

B. Investment Management

1.Investment philosophy

(1) Vertical integration of investment philosophy

Risun has always adhered to the development concept of vertical integration and has realized the integrated development from coke to chemicals industry, from coal chemicals to petrochemicals industry, and from petrochemicals to materials industry. Adhere to the coke and chemicals industry, we determine to develop in terms of specialization, fining, stronger and larger in scale in order to become the leading enterprise of coke and chemicals industry.

①The production base is an important carrier of Risun, we adhere to the integration, scale, centralization, ecological, intelligent implementation of the construction of production base by the "five-modernization and seven-unification". Also, we uphold to unify planning and development, infrastructure, operation and management, energy management, logistics and transportation, safety and environmental protection and research and development together with innovation to the management of production base.

②We believe that specialization, fining, stronger and larger in scale are inter-related, because specialization makes us fining, fining makes us stronger and stronger ability makes us larger in scale. It is our goal to be more professional and fining and to be stronger and larger in scale. This is the standard formulated upon listing and also our ability to strike through various business cycles.

Risun has always clarified transforming from coke to chemicals and from horizontal to vertical thinking in order to implement the vertical integrated development, and this will gradually grow into an energy refined chemicals enterprise with leading scale, leading technology, significant industrial chain advantages and excellent management.

(2)Strategic target of the largest in the World

Risun deeply believes that the average return on assets of the world manufacturing industry is not high and it is highly competitive, it is necessary to become the first position in the world in order to achieve the highest return on assets. The world's first includes: scale first, profit first, technology first, environmental protection first, energy consumption first, first, research and development first, any project that cannot become the first in "industry, production sector, product and service" in the world cannot be invested, which is the basic investment logic of the company.

Risun adheres to the strategic goal of being the world first, and has become the world's largest independent coke producer and supplier, the world's largest coking crude benzene supplier, the second largest producer of hot coal tar, the second largest producer of caprolactam; the largest producer of China's industrial producer of naphthalene benzene anhydride, the largest producer of coke oven gas methanol in China, and the largest hydrogen supplier in the China's Beijing-Tianjin-Hebei region.

The market share of coke of Risun continues to increase and the market share of China independent coke enterprises in metallurgical coke commodities has increased from 4.9% in 2021 to 5% in 2022, ranking the leading position in the industry. In 2022, not only the market share of coke output, but also refined chemicals is working hard to push forward steadily. The Cangzhou and Dongming caprolactam capacity expansion supporting projects invested and constructed have been put into operation smoothly, with an annual capacity of 750,000 tonnes, reaching the second position in the world, and is expected to become the new world first sector of the company in the future. The hydrogen business is growing rapidly; we have three high purified hydrogen production lines with capacity of 155,600 cubic meters / day (14 tonnes / day). In the future we will move towards the largest hydrogen energy supplier in China and the world.

2. Establishment of investment management and methodology

(1) Internal investment

The internal investment of Risun always adheres to the world's first and highest profitability of projects as its ultimate goal. All production bases are built and established to getting closer to customers, closer to logistics and transportation, and closer to raw materials suppliers. All internal investments will be conducted in accordance with six processes, namely project approval, project reporting, feasibility analysis, financial budgeting, investment committee's approval and archive. For each step of the process, there is a clear template in the management system, which will be carried out in three steps, namely project demand and feasibility analysis, project approval and investment implementation, so as to ensure that all equipment is reliable while achieving the lowest cost.

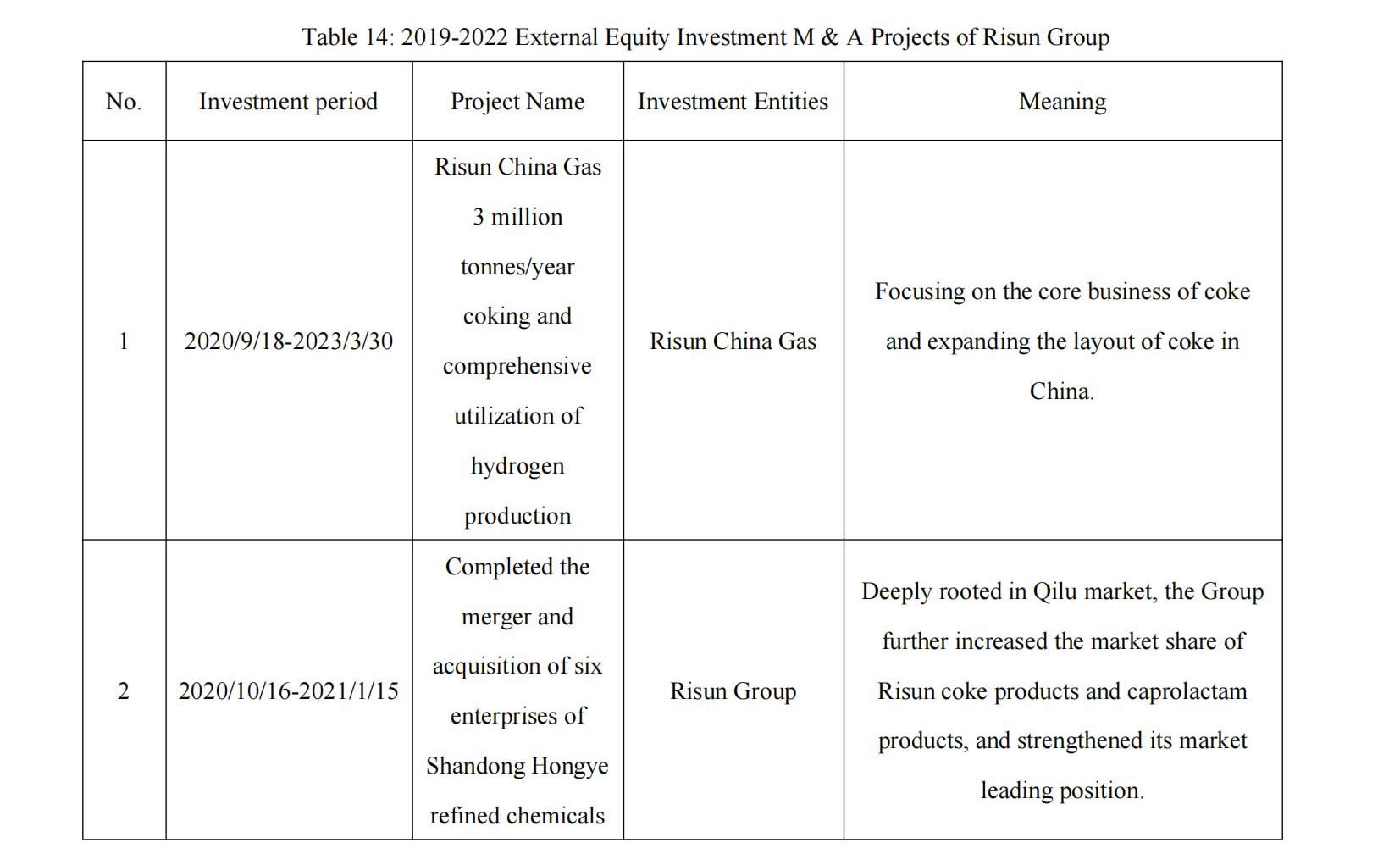

(2) Mergers and acquisitions ("M&A")

With the goal of becoming the world's number one in all industry sectors, Risun has formed a complete and sound system for external mergers and acquisitions. Many merger and acquisition cases in the world are not successful. Therefore, we adhere to the principle of first custody, re-merger and acquisition, and not cross-industry merger and acquisition. Also we have a strong management system and has formed five module processes, including project initiation and research, project approval authority and process, post-investment management, investment exit and exit report.

Risun has set up a research team for all investment and M&A projects. Through business negotiations, on-site due diligence and drafting of feasibility reports. We have standardized the seven major areas that must be concerned, including internal and external environment analysis, industry integration and self-development needs analysis, future development trends, project implementation arrangements, investment budgets, operational and financial manpower risk analysis, feasibility study conclusions and suggestions. After repeated discussions, it has provided the Company's investment committee and the board of directors with supporting materials for investment decision-making, achieving successful M&A of all projects.

(3) Systematization, institutionalization and process of investment management methodology

Relying on twenty-eight years of development experience, Risun has formed advanced research capabilities, clarified investment objectives for expansion and strengthening, and established a systematic, institutionalized and process-oriented investment management system:

① We insists on in-depth research on the characteristics of the industries to be invested, industry development trends and laws, as well as the important characteristics of the enterprise such as life cycle, organizational structure, technical threshold, profitability, investment return, and development direction.

② We are well aware of the characteristics of long investment return cycle in the manufacturing industry. Each investment is based on the current situation, summarizing various data research on the industry in three short cycles of 20 years before and after the industry where the project is located, and making good operating cash flow forecasts for the investment project for at least 20 years in the future.

③ We strictly controlled the static payback period of fixed asset investment projects to be "2 + 5" years (2-years investment and construction period, 5-years production and operation period), the payback period of M&A projects to be 7 years, and the payback period of technical transformation projects to be 3 years.

④ We have clearly defined its investment objectives to become bigger and stronger, established a sound investment management system and system, set up a professional investment and research team, and formulated strict and strict systems and procedures for feasibility study and demonstration of investment projects, investment assets and investment companies to strictly control various investment risks.

⑤ On the premise of meeting the company's strategic indicators and financial indicators, each investment is compared between different industries, and the return on assets and return on capital are relatively ranked internally.

⑥ We continued to upgrade cash flow management and control measures of investment, perform well in balancing cash flows in the previous three years, and properly matched the investment cash flows and the operating cash flows. It strictly controlled the investment payback period of the project, and drove the investment research and related activities to be carried out in a safe and stable manner.

3. Internal investment and external mergers and acquisitions

(1) Major investment and M&A projects from 2019 to 2022

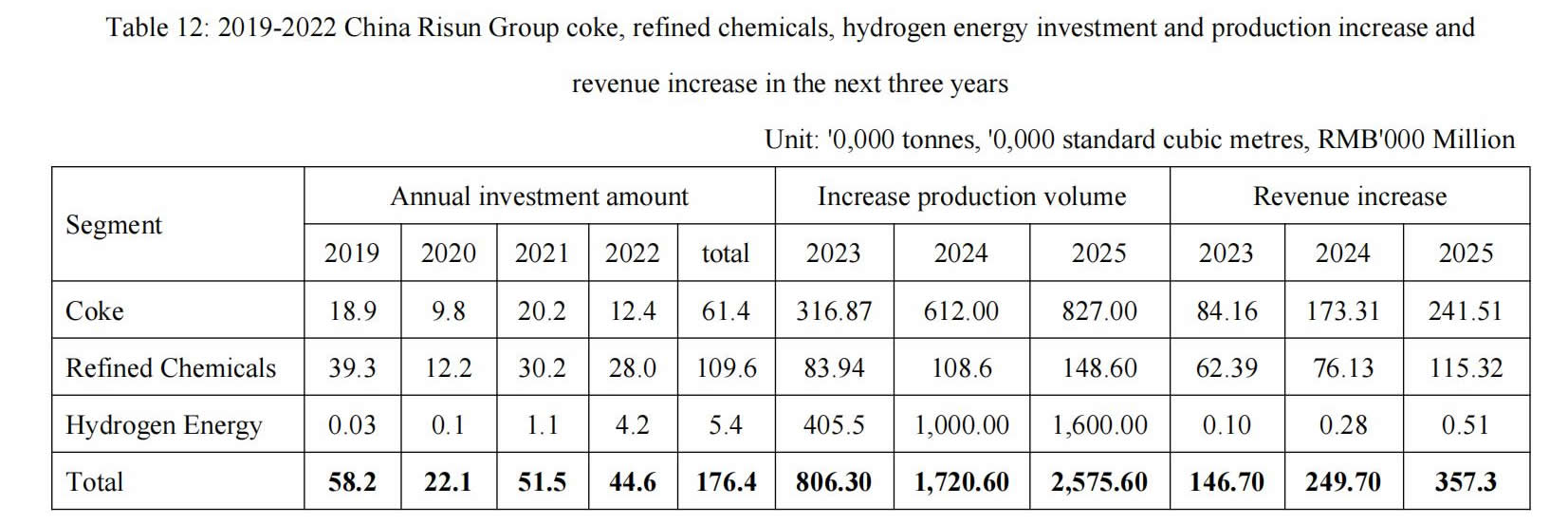

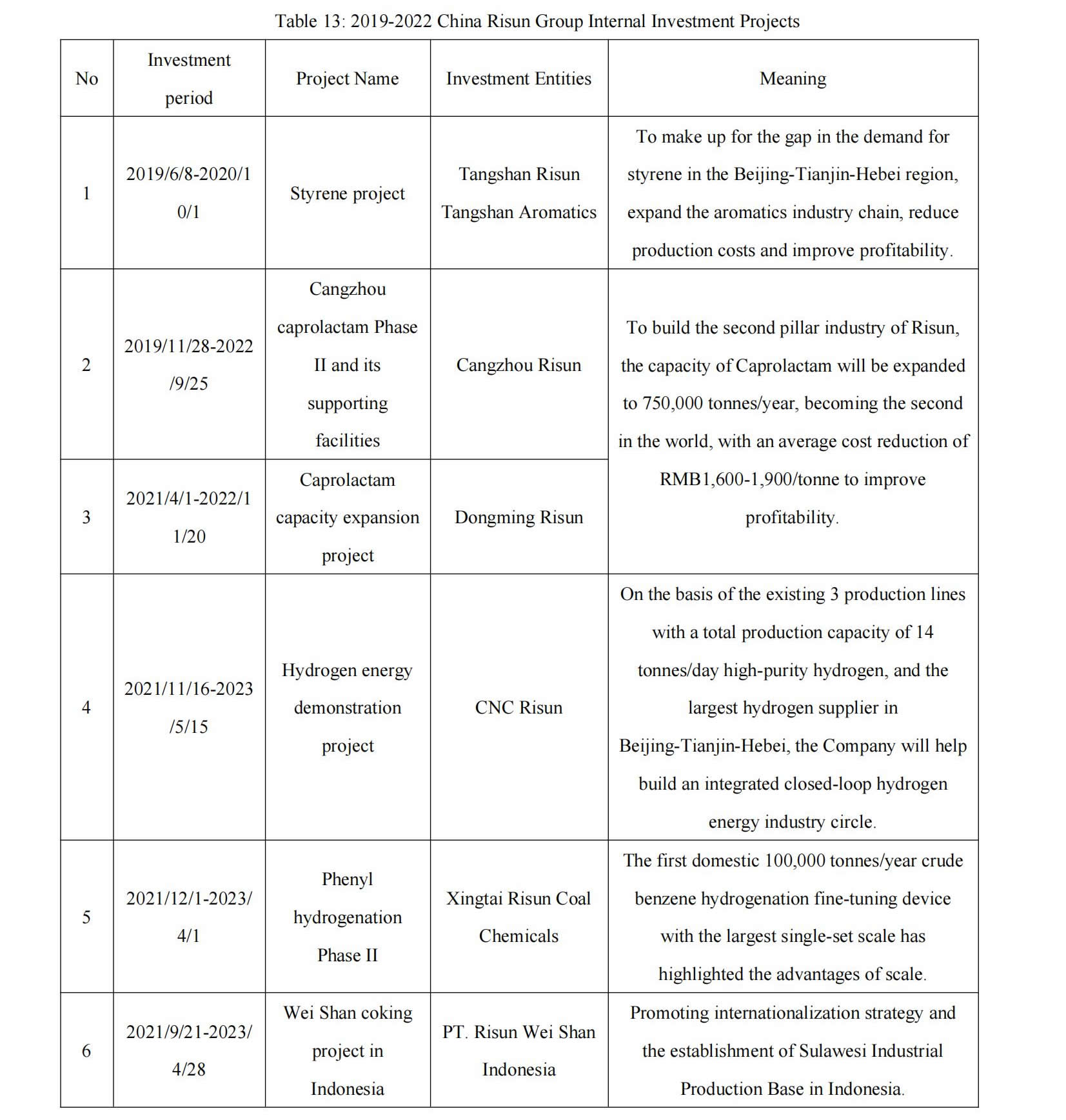

Risun coke business has a domestic layout and international expansion. Through a series of investment methods such as investment, mergers and acquisitions, equity joint ventures, entrusted operation, and capacity expansion construction, the production capacity of coke and coking chemicals has been improved and the technical barriers have been improved. We have successively deployed into eight key provinces in China and the scale has continued to expand. Over the past four years since listing, our coke segment has invested a total of RMB6,140 million and is expected to increase its production by 8,270 thousand tonnes and increase its annual revenue by RMB24,151 million by 2025, creating more investable intrinsic value for the coke business.

Risun not only continued to grow stronger and larger in scale in the coke business, but also laid out the refined chemicals industry chain and extended to the new energy and new materials industry chain. We have formed three refined chemicals industrial chains, namely carbon material chemicals, alcohol-ether chemicals and aromatic chemicals. For the four years from 2019 to 2022, the total investment of the refined chemicals segment was RMB10,960 million, and the estimated output will increase by 1,486 thousand tonnes and the revenue will increase by RMB11,532 million in 2025. With the implementation of caprolactam's capacity expansion and supporting projects, the scale and cost advantages have gradually emerged, and the revenue scale and profitability of refined chemicals' industrial chain will reach a new high in 2023.

Since its listing, Risun has been continuously investing in the new energy industry – hydrogen energy, with a total investment of RMB560 million. We continue to expand in terms of production, storage, transportation, processing, research and application, and accelerates the growth of the new energy segment.

(2) Key Investment and M&A Projects in 2019-2022

Risun has focused its investment and acquisition efforts primarily on the coke, chemical, new energy, and new material industries, with allocation and prioritization based on respective proportions. While concentrating on its core business, the company has extended its reach from traditional energy sources to new energy and has established a coke and coking chemicals energy ecological industrial chain. We have built a balance between coke and refined chemicals development, a linkage balance between three refined chemicals production lines, an asset-light and asset-heavy asset allocation balance, and a balance between domestic and foreign layouts, further strengthening its leading position, improving profitability, and formulating a refined development plan for the sustainable development of the company and the industry.

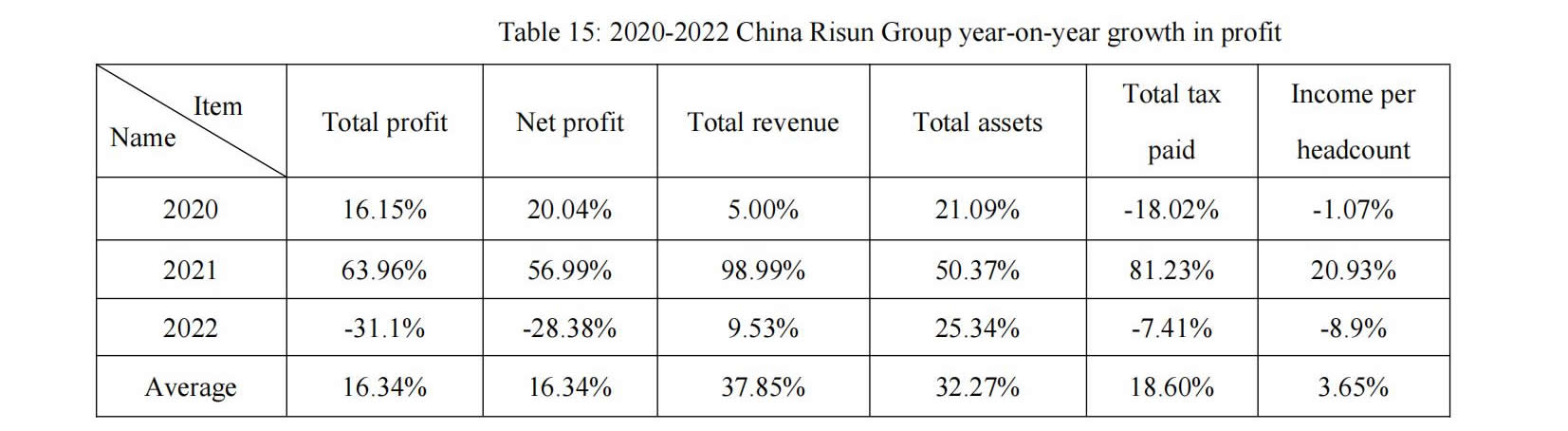

2.4 Earnings driven by investment

Over the past four years since its listing, Risun recorded an average increase of 37.85% in total revenue and an average increase of 16.34% in total profit and net profit, which demonstrated the high rate of return of the fixed assets and current assets, verified the high rate of return of the Company's project investment, strengthened control of project investment, and zero error rate of investment. While developing itself, we never forget to give back to the society. From 2019 to 2022, the average growth rate of total tax paid was 18.6%, and the average growth rate of employee income was 3.65%, contributing its own strength to the development of the society.

In 2023, all investments of Risun will be fully transferred to the return period of production operations and investment income, driving higher investment returns and achieving the world's first goal. At the same time, since the beginning of the year, the upstream coal price has declined, the manufacturing industry has fully recovered, the demand for downstream steel has increased, and the external economic environment has continued to improve, which will promote the Company's operation and investment results to achieve the increasing trend of scale gains, and bring more substantial investment returns to shareholders and investors. Risun's past investment, current investment and future investment will continue to strive for the goal of "industry, production sector, product and service" to become the world's first place.

C.Management ofDebt Ratio

1. Risunmanagement philosophy ofdebt ratio

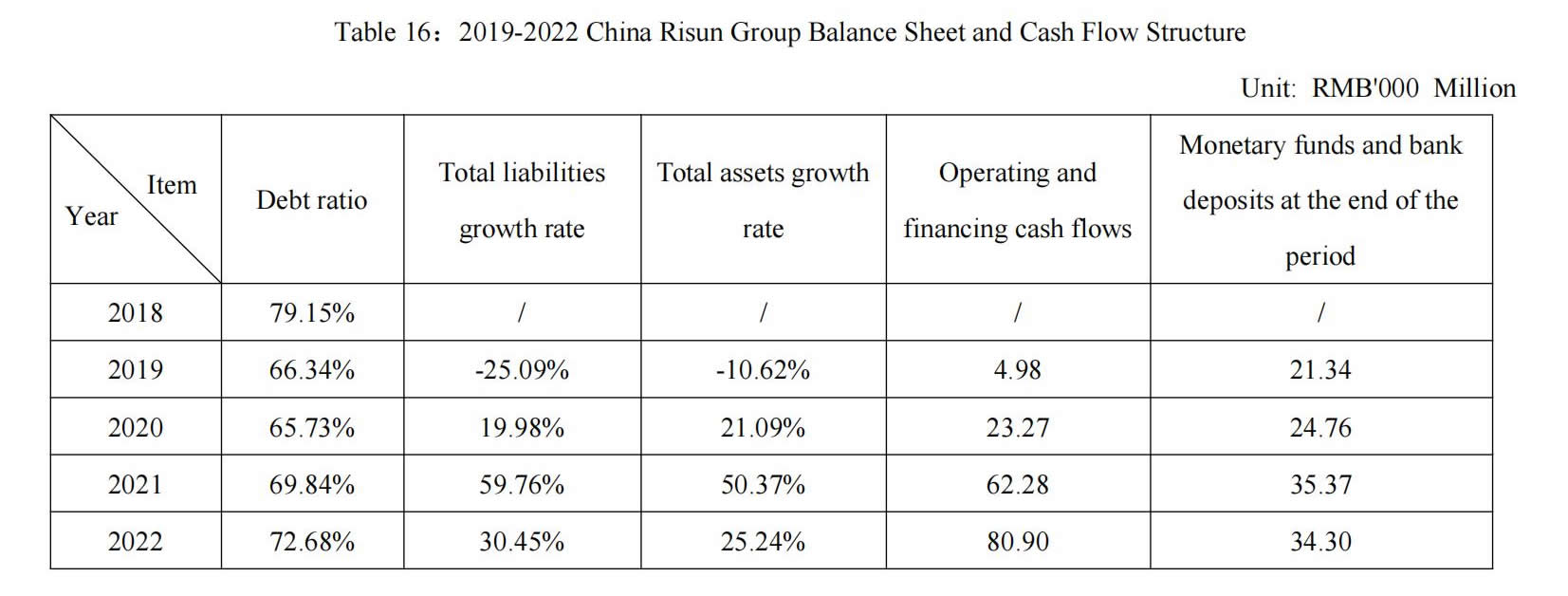

The development and growth of most enterprises in the market economy system will inevitably come with certain liabilities. Reasonable and healthy debt ratio can help enterprises expand, improve return on net assets, and also reflect the strong operating capability of enterprises.

Risun has a total of about 4,300 financing loans under development for twenty-eight years and there has been no default so far, which strongly supports the building of Risun's strong brand. We deeply summarized the scale and structure of interest-bearing liabilities and conducted data-based management and control of interest-bearing liabilities. We also always adhere to the policy that the total annual investment is less than the annual net profit and total depreciation, strengthens cash reserves, and maintains the leading position in the industry in terms of return on assets, operating income and per capita profit under the limitation of reasonable debt ratio. We have proposed five liability control measures for liability control, including financing structure control and safety reserve fund control, operating cash control and investment cash control, and has achieved stable cash flow regardless of changes in external environment.

2. Risun management experience ofdebt ratio

(1) Investment growth anddebt ratio

Risun has complete investment, cash reserves and debt plan, strictly implement the annual investment, which is not higher than the total amount of net profit and depreciation policy, also each investment has a medium-and long-term loan of 6 years. Through cash flow and debt investment portfolio, it strictly controls the scale of liabilities to maximize investment returns, optimize investment costs and minimize investment risks.

Risun fully implemented the cash reserve plan, predicted the scale of annual cash flow through industry and market research, and achieved a high match between operating cash flow and debt plan. With stable operating and financing cash flow, cash at bank and on hand at the end of the period and bank deposits, the investment grew steadily, forming a complete closed loop from investment to liability and then to asset return.

(2) Risun management capacity against change inDebt ratio

In 2022, with the gradual expansion of Risun and the gradual improvement of its risk resistance capacity, we believe that it is necessary and confident to bring long-term stable returns even through efficient investment in the industry downturn cycle. We firmly believe that although the debt ratio will change and the product line will have a certain period of time, regardless of the change in the debt ratio and product cycle, the investment portfolio of different products can achieve stable and long-term profits.

Risun has gone through the stage of debt ratio change, and firmly believes that the fluctuation of debt ratio is temporary. In 2019, we achieved a year-on-year decrease of 25.09% in debt ratio. In 2023, with the recovery of the industry, the investment will gradually recover costs, the capital market and equity structure will continue to optimize, and the profit will increase rapidly, the debt ratio will drop to 70% or lesser.

3. Risun managementmeasures ondebt ratio

Risun always clarifies long-term cycle goals for project investment, and always insists that the total amount of credit is greater than the total amount of interest-bearing liabilities, and implements strict control strategies on the debt structure based on the actual situation, so as to promote the development of the Company in a timely and reasonable range of liabilities. Our liability control strategy is mainly divided into five capital control, namely Financing Structure Control, Safety Reserve Fund and Other Five Funds Control, Operating Cash Flows Control and Investment Cash Control. We improve the rate of return on project investment by four measures, stabilize the project control ability, implement the balance of investment liabilities, achieve high return on assets, high turnover rate of current assets, and zero error rate of investment, and build a solid liability management system.

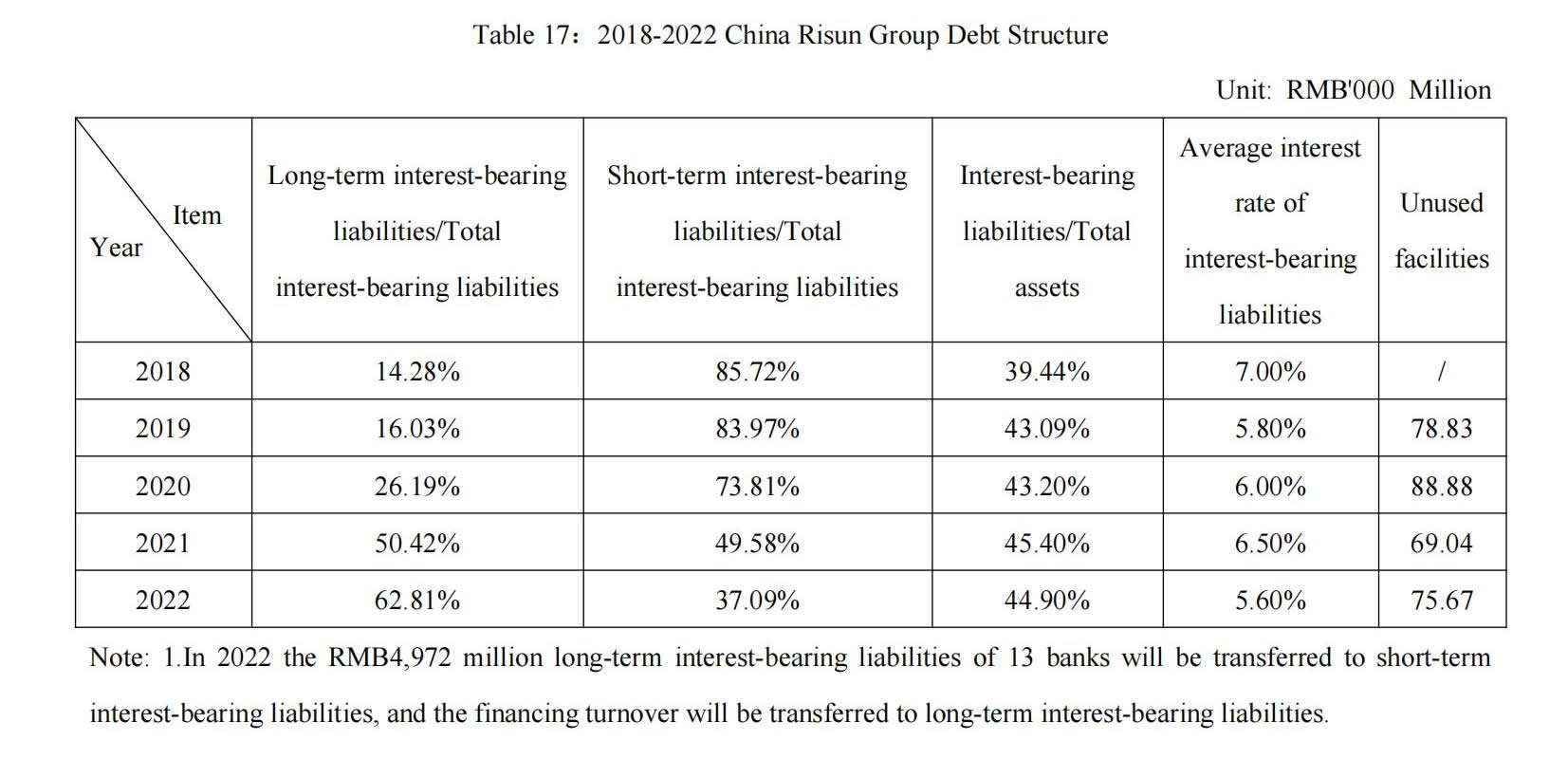

(1) Management of Financing Structure

Risun has a stable cash flow reserve, and is also actively carrying out debt financing and equity financing control. In the past, corporate financing was mainly through debt financing for three reasons:

Firstly, total credit extended to cover interest-bearing liabilities

We always maintain the total credit amount to cover the total interest-bearing liabilities, and always ensures that the net interest-bearing liabilities/EBITDA are within the standard range of bank credit, and continues to obtain credit facilities from the head office of financial institutions, and the credit scale continues to grow.

Secondly, strong financing management and control capabilities

We maintained a long-term and short-term debt balance and reduced the cost of debt financing. The proportion of long-term interest-bearing liabilities/total interest-bearing liabilities increased steadily, and the proportion of short-term interest-bearing liabilities/total interest-bearing liabilities and interest rate of interest-bearing liabilities decreased gradually.

Thirdly, priority for investors

We always give priority to the interests of shareholders and investors, and firmly believes that the future share price and market value have significant growth potential, and future equity financing can protect the interests of shareholders and investors.

(2) Safety Reserve and Five Funds Management

Risun continues to strengthen and clarify the control target of total debt ratio. In the past four years, the target of total debt ratio was controlled under 70%, and each liability must have risk control measures.

①We continued to strengthen the capital management system, established, improved and strengthened the five capital management systems of safety reserve funds, special merger and acquisition funds, financing working capital, project investment funds and operating working capital, and unified capital management and scheduling.

② We always ensures that the safety reserve fund shall not be less than 10%-15% of the interest-bearing liabilities and shall be directly managed by the Board and senior management of the Company. In order to achieve efficient development and transformation, we have formed a balance between special merger and acquisition funds and project investment funds at a ratio of 1: 1. While expanding the traditional business segments such as coke and refined chemicals, we have accelerated industrial transformation.

(3) Management of Operating Cash Flows

Risun always strictly abides by the advance receipt system, strictly controls all kinds of inventories, adheres to the zero inventory system, and continues to maintain inventory turnover days and return on assets far higher than the industry, so as to ensure the stability and sufficiency of operating cash flows. Relying on product quality, we established the brand effect of Risun in the upstream and downstream of the industrial chain. On the basis of realizing advance receipts, we reasonably controlled accounts payable and prepayments, increased the proportion of non-interest-bearing debts such as operating liabilities and construction liabilities in liabilities, decreased the proportion of interest-bearing liabilities/total assets, and gave full play to the maximum advantage of cash flows to ensure the Company's sufficient cash flows.

(4)Investment Cash Control

Risun is well aware that there are inherent risks associated with investments. We always treat investment risk as an important part of liability management and control risk. Through the ten-year outline and five-year plan, we control investment in strict accordance with indicators such as return on investment, return on assets, and gross profit margin of products and services. We strictly follow the ranking of projects and makes investment at different levels to achieve the best return on investment and zero error in investment.

Risun minimized the risk of debt ratio through strict control measures on investment cost and debt ratio. At the same time, by virtue of its high investment return rate and project control ability, we achieved zero error in investment and high turnover rate, achieving a continuously higher return on assets than the industry.

D. Lifeline of Risun

Over the past twenty-eight years, Risun has always insisted on taking safety, environmental protection and quality as the lifeline of the enterprise. We are responsible for social safety, customer quality and government standards, and continues to establish unique industry standards, domestic standards and international standards to ensure the full production of all production bases, the profitability of all segments, the availability of all production capacity, and the establishment of the world's first benchmark to achieve sustainable high-quality development.

4.1. Safety, environmental protection and quality

(1) Safety

Risun always insists that safety is the most basic premise for survival and development, and has maintained a record of "zero" major safety accidents since its inception. In terms of safety management, we strictly implement various safety laws, regulations and policies, establishes safety management agencies, improves safety organization and management network, and establishes a six-level safety management and control system.

Risun adheres to full investment, full utilization and year-on-year increase in safety, establishes safety management and systems, implements safety responsibility system, target management, standardized operations, risk hazards, dynamic monitoring of occupational health, emergency response, training and publicity, systematically builds an intrinsically safe factory management model, and fulfils the Company's and social safety responsibilities.

(2) Environmental protection

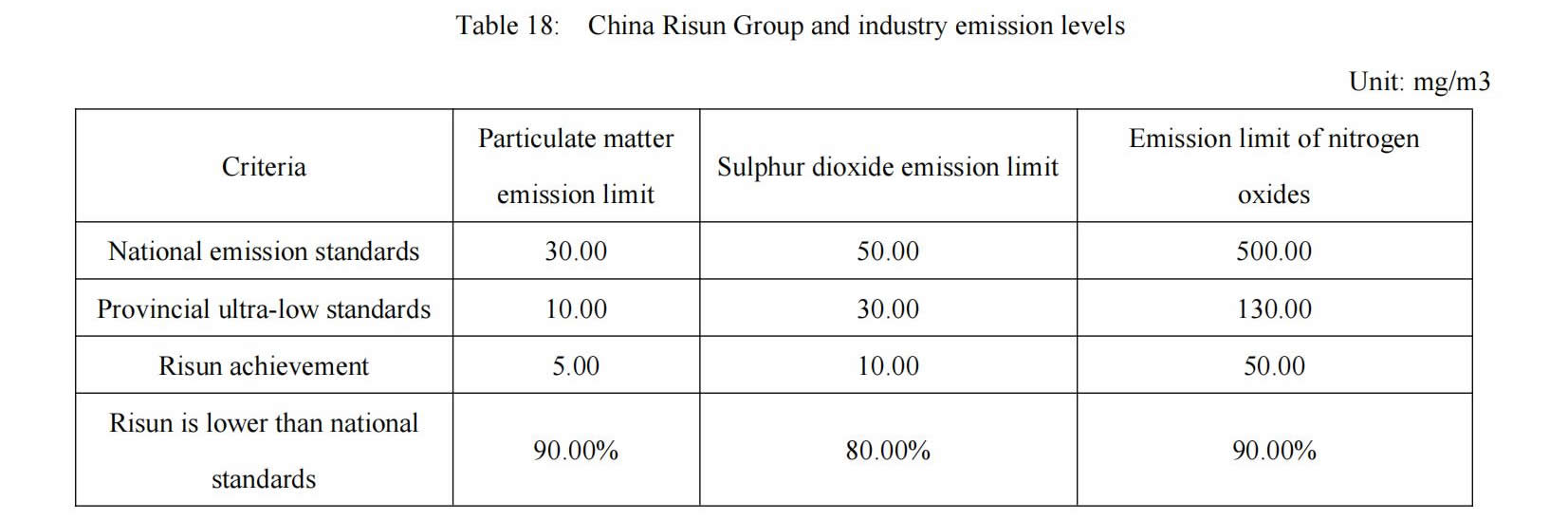

Risun always adheres to the bottom line of environmental protection, actively promotes the establishment of advanced corporate environmental protection governance concepts, earnestly undertakes and takes the lead in fulfilling it, and is committed to building green production bases, clean factories and clean production lines, continuously improves the green production and operation level of the production bases, and strictly implements the government's standard responsibilities. As of 31 December 2022, the cumulative total investment in environmental protection was RMB 6,483 million, 149 key environmental protection projects were built, and a special environmental protection research institute was set up, 69 patented technologies were formed, ultra-low emissions were fully realized, and ultra-low emissions were realized in some production bases.

Risun actively carries out technological innovation in environmental protection treatment, strictly complies with environmental protection laws, regulations and standards, adopts more advanced environmental protection production technology, upgrades and transforms process equipment, stabilizes the operation of process equipment, and monitors pollutant emissions in real time, further reduces costs, increases profits, and expands the scale of entrusted mergers and acquisitions. We have eliminated a total of 4,100 thousand tonnes of obsolete coke and coking chemicals production capacity, and 71 energy-saving technological transformation projects have been carried out in each industrial production base to gradually phase out high-energy-consuming equipment, improve the energy utilization rate of equipment, and reduce unnecessary energy consumption.

(3) Quality Management

Risun always insists on taking advantage of quality to hold the dominant position in the industry and to form sustainable survival and development abilities. We implement the concept of customer-centric and creating value for customers, and promotes the development of M&A custody while being responsible to customers. Our comprehensive quality management model focuses on customer requirements, and product development, product production and service are all based on meeting customer requirements.

① Coke: Risun No. 1 coke is developed for the production of large blast furnaces and has the characteristics of good strength, low sulphur content and low volatile matter content. It is currently used in the 2,000 m3 blast furnace of Hebei Jinxi Iron and Steel Co., Ltd.

②Refined Chemicals: The quality of benzene hydrogenation products has reached the level of petroleum benzene. The Caprolactam products have been applied to the downstream filament market and applied to high-end engineering plastics and multi-layer co-extrusion films in BASF.

2.How to stick to the lifeline

Risun operates in the coke and refined chemicals industries with two distinct characteristics: firstly, they are the basic and pillar industries in the national economy, with high output value and numerous enterprises involved; Secondly, in recent years, with the increasingly severe situation of safety and environmental protection and the increasingly strict national environmental protection and safety regulations, the coke and coking chemicals enterprises are facing huge survival pressure.

Over the past twenty-eight years, Risun has continued to develop and achieved world-leading positions in a number of products. We always adhere to the three lifelines of safety, environmental protection and quality, insists on investing a large amount of funds, strictly controls processes, increases R&D and innovation, and puts forward strict requirements for management capabilities and talent quality.

(1) Capital investment

As of 31 December 2022, the total investment in environmental protection of Risun has reached RMB6,483 million, and 149 key environmental protection projects have been built, and a dedicated environmental protection research institute has been set up, and 69 patented technologies have been formed. We continued to promote the key construction of safe production informatization of"replacement of personnel with mechanization and reduction of personnel with automation". As of December 31, 2022, we invested RMB970 million to complete 62 informatization projects. In terms of quality, professional personnel are assigned to all aspects of sales, transportation, production and supply. Through on-site customer research, peer benchmarking, coal blending working group and other comprehensive management, product quality is improved and investment returns are implemented.

(2) Strict management

Risun has always strictly implemented safety management, set up a special safety management committee, implemented safety management integration in the production base, and set up a safety organization in the workshop. We implement the responsibility-to-person system. The workshop director is the first person responsible for safety at the production line, and each person is the executor of safety management. In addition to meeting national and local standards, we have formulated more stringent safety standards, with 152 environmental protection and safety staff responsible for environmental protection and safety matters, regularly organized joint inspections, mutual inspections and special inspections by experts, and fully implemented strict management and safe production.

(3) Technological innovation

Risun has always adhered to all-round innovation, comprehensive innovation, system innovation and collaborative innovation. In 2022, our R&D expenditure was RMB1,227 million, expenditure accounts for 3.02% of the revenue of the 8 high-tech enterprises. Based on the three-level R & D and innovation system of "Production Technology Department — Engineering Centres in Each Park — Production Companies", we continue to carry out technological innovation. We have 8 high-tech enterprises, 407 technical research and development personnel, 2 provincial-level engineering technology research centres, 2 provincial-level technology innovation centres, 1 provincial-level key laboratory, 4 provincial-level enterprise technology centres, 6 provincial-level new research and development institutions, 3 national-level testing centres, academician expert workstations, post-doctoral workstations, post-doctoral innovation practice bases and other research and development platforms.

(4) Continuous improvement

Risun always adheres to the continuous improvement of safety, environmental protection and quality. We have continuously replicated its existing experience to newly built and acquired production bases and operation management devices to improve its safety, environmental protection, quality management level and technical level and form a unified standard. Also, on the basis of the original management system, we continue to learn, benchmark and improve the management level, and further improves the technical level through self-owned research and development, technology introduction, cooperation and other forms.

3.Achievement of social and economic benefits

Risun always adheres to the three lifelines of safety, environmental protection and quality, and has achieved a continuous and steady increase in social and economic benefits. The Company's ESG governance system has been continuously improved, and the amount of green loans and management efficiency have increased rapidly; Long-term emphasis is placed on social responsibility and enhancement of social benefits.

The Company continued to innovate and create, optimized costs and expenses through tax-saving policies for high-tech enterprises, and promoted profit growth; Adhering to the concept of green production, the Company has been awarded as a green production base for years, and obtained benchmarking visits from the government and peers to improve brand efficiency and promote entrusted mergers and acquisitions.

(1)Social benefits

Risun has published its ESG report for four consecutive years, and published its first independent ESG report in April 2022, so as to promote the improvement of the ESG system, assume environmental responsibility and promote the significant improvement of social benefits.

①We promote ESG improvement through safety, environmental protection and quality system. We took the initiative to assume the safety responsibility of employees and held safety and environmental protection training activities to continuously enhance employees' sense of belonging and strengthen team execution. Also, we enhanced the interaction between the Company and the community through community activities such as the Environmental Open Day, allowing the Company to enter the community, further enhancing the Company's community influence and improving community cohesion.

②Since the listing, we have promoted the construction of ESG management system on the basis of safety, environmental protection and quality, and has won the honorary titles and awards such as the National Technology Progress and Innovation Coke and Coking Chemicals Enterprise, the National Energy Efficiency Leader in the Coke and Coking Chemicals Industry, the National Green Industrial Park, the National Green Factory, and the National Green Supply Chain Management Model Enterprise. Last year, we received two awards from the Hong Kong Quality Assurance Agency, namely "ESG Disclosure Optimization Pioneer" and "Outstanding Green and Sustainable Loan Issuer (Raw Materials Sector) – Vision of Excellence Sustainability-Linked Loan Performance Index".

③ We actively plan and implement the diversity and inclusion strategy, and takes corresponding measures to improve the diversity of the background, age and gender of the Board members, and enhance the innovative competitiveness. At the same time, taking into account the relevant suggestions of the Hong Kong Stock Exchange on the ESG structure of listed companies and benchmarking with outstanding companies in the industry, we optimized the ESG management structure and gave full play to the Board's decision-making and supervision role in ESG matters.

(2) Economic benefits

Tax saving and fee reduction to improve economic benefits:

We have been committed to R & D and innovation for a long time, and has 8 high-tech enterprises. The enterprise income tax has been strongly supported by the state and the government, and the tax rate has been reduced from 25% to 15%. From 2019 to 2022, a total of RMB981 million in taxes and fees were saved, accounting for 77% of the revenue of manufacturing companies, which helped us to reduce its overall production costs significantly. On January 1, 2018, China officially started to change environmental protection fees to taxes. The Company's excellent environmental protection governance level greatly reduced environmental protection taxes, and further promoted the implementation of the cost reduction and efficiency improvement plan.

Green credit to promote sustainable development:

We always attach great importance to its own green operation, continues to increase investment in relevant funds and personnel, and cooperates with a number of domestic and foreign commercial banks to organize sustainable development performance-linked loans for the green and low-carbon upgrading and transformation of production processes. Our environmental protection level continued to improve. A number of subsidiaries were approved as environmental-friendly A-level performance enterprises, and the total amount of sustainable development performance-linked loans reached RMB2,402 million.

Green production to promote entrusted mergers and acquisitions:

The Company was included in the list of 2022 provincial safety culture demonstration enterprises published by the Emergency Management Department of Hebei Province, and 3 subsidiaries were awarded as national green factories for years. We have received more than 850 safety and environmental visits from governments at all levels and peers in the industry, and has been invited to assist the government and peers in the construction of environmental protection systems for many times, which has greatly promoted the expansion of operation management services. We have achieved green and sustainable production for years, implemented fully planned production, achieved production capacity availability and guaranteed production period, continued to enhance the competitiveness of its brands and products, and contributed to the stable and continuous growth of economic and social benefits.

E. GROWTH IN 2023

1.Increment of Production and business volume in 2023

The breakdown of expected new projects in 2023 is as follows:

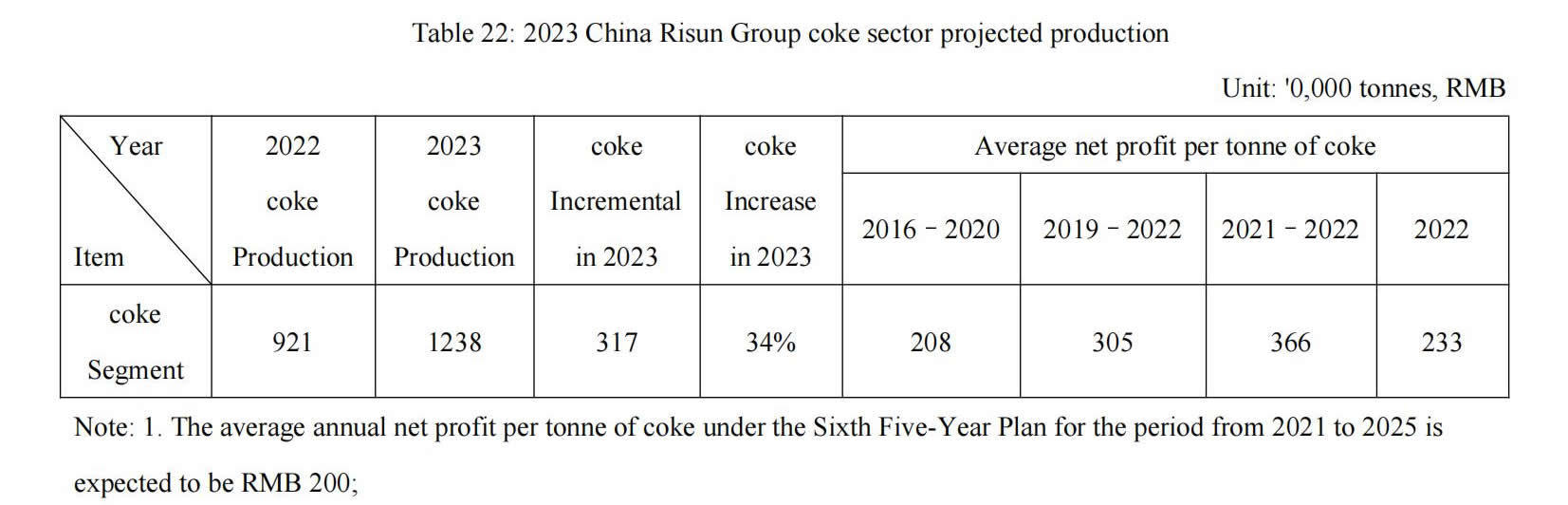

(1) Coke continues to ramp up production with stable profitability

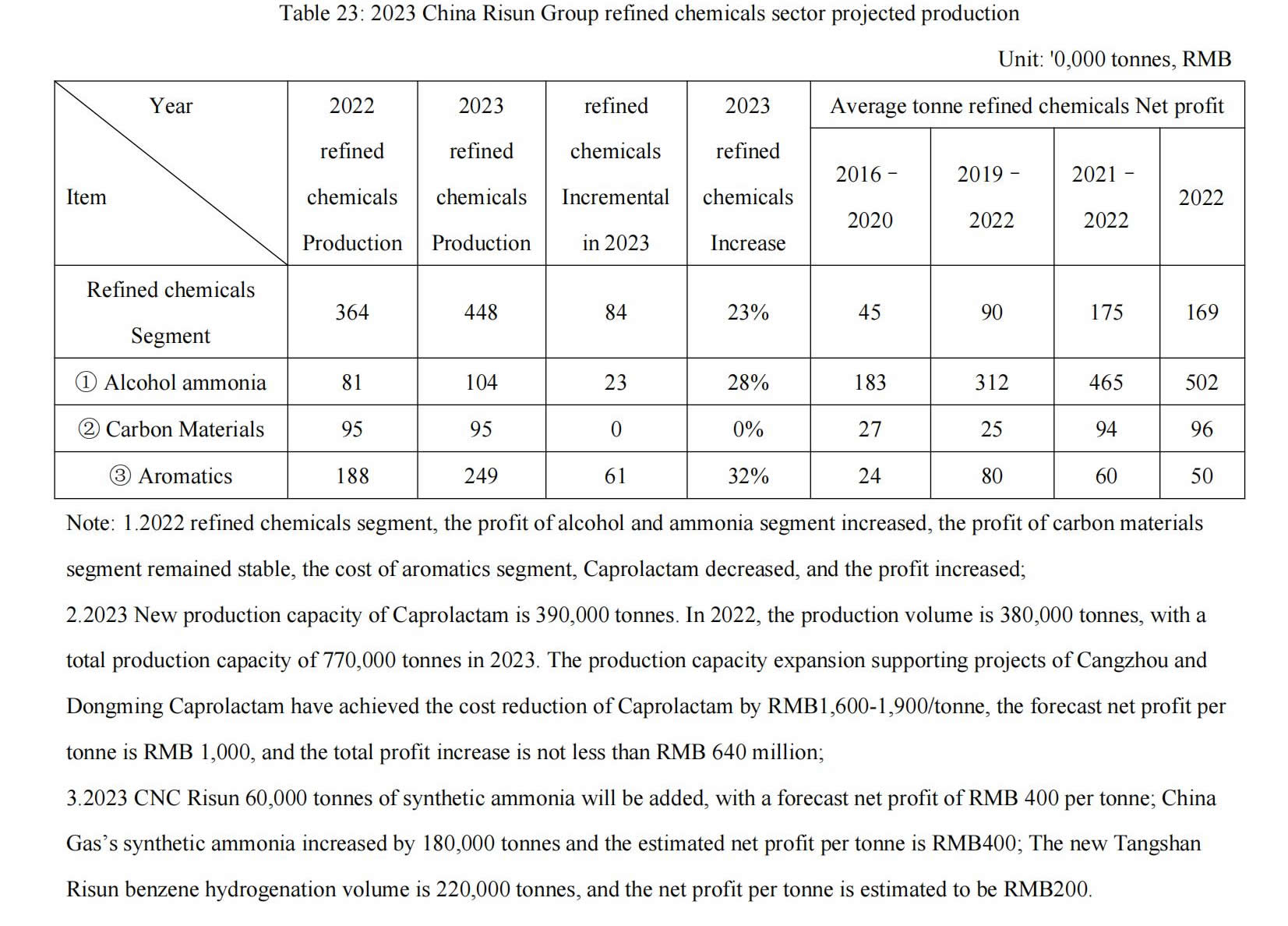

(2) Refined chemicals Segment Caprolactam with comprehensive ancillary facilities, profit increased significantly

(3) Operation management Service scope expanded and market share increased

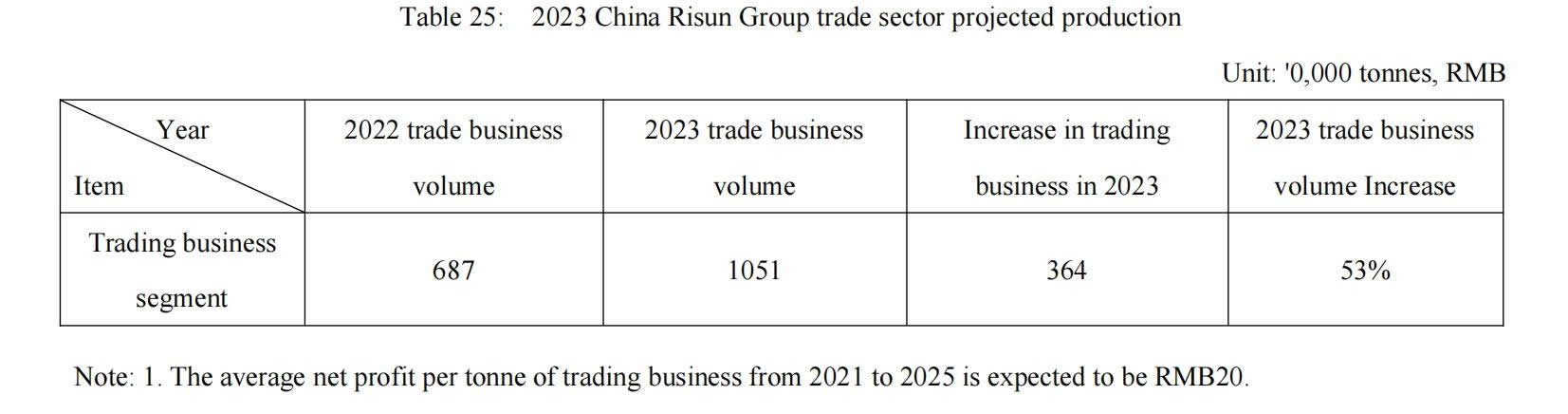

(4) Accelerated expansion of trading business with stable increment

(5) Hydrogen energy business started to bear fruit

In 2023, Risun's coke continued to grow in scale with stable net profit per tonne of coke. In the refined chemicals segment, the cost of Caprolactam decreased significantly and the profit increased significantly; The production of synthetic ammonia and benzene hydrogenation was completed and put into operation to accelerate profit growth. operation management and business volume were upgraded, and the scope of asset-light operation was further expanded. hydrogen energy's business continued to expand and grow steadily. The overall profitability of the five major businesses is promising, laying a strong foundation for the Company's overall profitability in 2023.

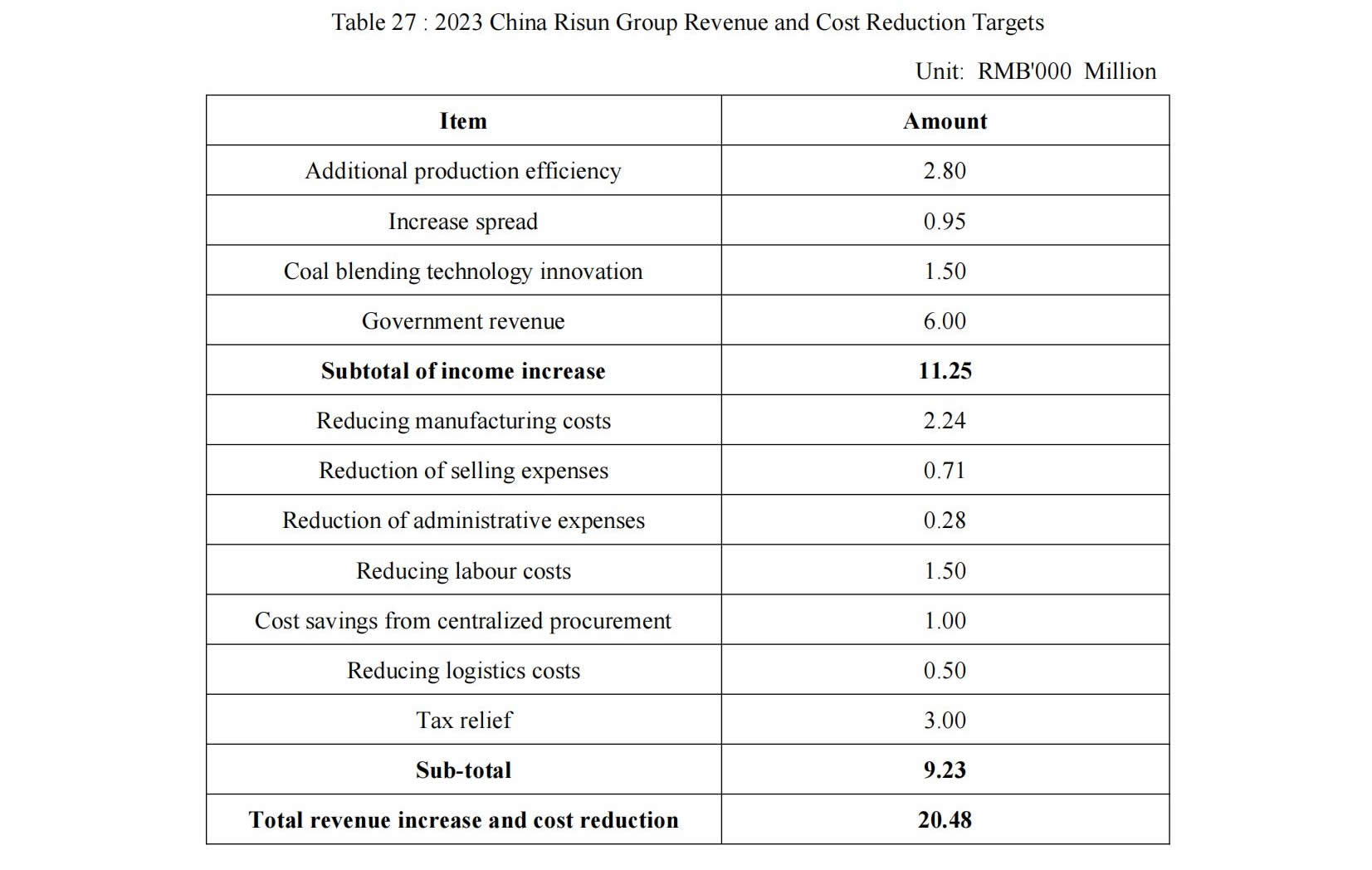

2. Increase revenue and reduce expenditure, reduce costs and increase efficiency

(1) Background of increasing revenue and reducing expenditure

In the beginning of 2023, the pandemic was lifted, the domestic economy recovered, and the bulk material market recovered. However, the consumption and real estate downstream market have not yet fully recovered. Risun has always maintained a deep sense of crisis in the external situation and survival, and continued to implement the strategic policy of"controlling investment, reducing costs, and increasing efficiency" to ensure the balance of cash flow and contribute to the steady growth of performance. In order to ensure the completion of the performance target for 2023, we have proposed the goal of reducing costs and increasing profits by RMB2,048 million on the basis of increasing production and increasing profits, so as to ensure the achievement of the financial target for 2023.

(2) Target plan to increase revenue and reduce expenditure

In order to improve the operating efficiency, optimize the costs and expenses of sales, transportation, production and supply, and continuously optimize the financing structure and cash flow of the company, Risun has proposed three measures to increase revenue and reduce expenditure for the long-term stable development of the Company.

Firstly, sales and transportation:

①We adjusted the structure of sales and delivery, increased the proportion of one-port-of-shipping freight, and reduced the overall freight rate on the basis of ensuring the ex-factory price of coke. Through bidding, the transportation costs of saving automobiles were reduced and the freight charges of water transportation were reduced.

②We conducted research on the freight rates of surrounding transportation markets and the bidding prices of transportation companies, benchmarked the optimal flow to reimbursement, formulated flow to assess the freight rates, and achieved the same flow below the surrounding freight rates. We will deepen the market research on the marine transportation market, bid for freight rates and negotiate for price, increase the effective shipping supplier to participate in benchmark price comparison, reduce shipping fees, continue to negotiate port fees, and strive for the greatest benefits.

Secondly, production and supply:

①All devices of the company achieve stable, full and high production, put an end to on-site running and dripping, carry out special management activities of on-site running and dripping, improve the proportion of self-power supply, reduce production costs and increase the control of manufacturing costs.

② Summarizes the expenses on a weekly basis, strictly controls the manufacturing costs, refines into every item, and reduces unnecessary expenses. We will strengthen the balance of energy medium in the park, reduce the consumption of energy medium, eliminate the waste of energy medium, and adjust it from time to time according to the market conditions to favour high-yield products.

Thirdly, expense management:

① We strictly controlled various expenses such as vehicle expenses and entertainment expenses. The Bank strictly reviewed and approved bill discounting, strictly controlled discount expenses, enhanced cash liquidity, reduced costs and expenses, and further controlled the costs of sales, transportation, production and supply.

② We continued to optimize the cost and maturity structure of existing financing, replaced high-cost financing with low interest rate financing, and replaced short-term loans with long-term loans. The Group will strengthen the negotiation with financial institutions and obtain more favourable interest rates for new financing.

(3) Implementation of cost reduction and efficiency enhancement measures, methods, responsibilities and assessment

Risun strictly implements cost reduction and efficiency enhancement in accordance with "one investment, five expenses and two costs", namely investment, manufacturing expenses, sales expenses, financial management, administrative expenses, research and development expenses, labour costs and tax costs.

In order to achieve the goal of"increasing revenue and reducing expenditure, reducing cost and increasing efficiency" of RMB2,048 million (increasing revenue by RMB1,125 million and saving expenditure by RMB923 million), Risun carried out responsibility decomposition and control in two dimensions, horizontal and vertical, and formed matrix double responsibility management and control. Horizontal control: The corresponding measures and responsibilities are divided into the management department, the general manager and the senior vice president in charge; Vertical management and control: The corresponding measures and responsibilities shall be assigned to the general manager and vice president of each park company, and each data shall be assigned to each responsible person to form a closed-loop management.

3. Increase Profitability Capacity by Various Methods

In 2022, Risun still achieved outstanding operating results in a difficult external environment. coke achieved a production volume of 9,214.5 thousand tonnes and a net profit attributable to the parent of RMB1,520 million; refined chemicals achieved a production volume of 3,637.6 thousand tonnes and a net profit attributable to the parent of RMB160 million; operation management achieved a net profit attributable to the parent of RMB40 million from business volume of 1,682 thousand tonnes and a net profit attributable to the parent of RMB140 million from business volume of 6,873.7 thousand tonnes and a net profit attributable to the parent of RMB1,855 million for the year.

In 2023, the upstream coal imports increased, the domestic production capacity was released, the price decreased significantly, the downstream infrastructure investment increased, the real estate demand rebounded, the automobile consumption gradually increased, the steel demand increased, and the external environment gradually recovered. Risun will continue to make efforts in the four major segments, namely coke, refined chemicals operation management and trading, with multiple measures in place, and the net profit is expected to continue to increase steadily.

① Through the Five-Year plan and Ten-Year outline, that has made long-term forecast and planning for the scale expansion and profit growth of the four major segments of coke, refined chemicals, operation management and trading. In 2023, the production scale of coke and refined chemicals is expected to increase by 317 and 840,000 tonnes respectively as compared with 2022, and the net profit per tonne of coke is expected to reach RMB200 during the"Sixth Five-Year" period of 2021 - 2025; The refined chemicals segment predicts that the net profit per tonne will be RMB600 during the "Sixth Five-Year" period from 2021 to 2025. In 2023, Caprolactam achieved an increase in production of 388.7 thousand tonnes, with a cost reduction of RMB1,600 - 1,900 per tonne, and is expected to achieve a net profit of not less than RMB640 million for the year. In 2023, the scale of operation management and trading business is expected to increase by 135 and 3,640 thousand tonnes, respectively, as compared to 2022. It is expected that operation management and trading segment will achieve a net profit of RMB 20 per tonne during the "Sixth Five-Year" period from 2021 to 2025.

②We have formed an efficient management system through the management of sales, transportation, production, supply and expenses, and has assigned the responsibility of increasing revenue, reducing expenditure, reducing costs and increasing efficiency to all cadres and employees of the Company to ensure the completion of the RMB2,048 thousand cost reduction and efficiency enhancement goal, and has built a double-layer insurance for the profit growth this year.

The historical earnings figure of Risun have demonstrated the Our continued profitability, stable growth and the outstanding results of all investments reaching full production capacity and efficiency. With the full implementation of cost reduction and efficiency enhancement, we believe that it can achieve better results in 2023 with clear industry, product and growth logic.

In 2023, the new production capacity of Risun's coke, refined chemicals and hydrogen energy projects in China and overseas will be gradually put into operation, and the scale and trading volume of operation management will continue to expand, especially the cost of caprolactam will decrease significantly. We will also continue to explore upstream and downstream businesses to create a unique industrial chain ecosystem and enhance the synergy of upstream and downstream businesses. It is believed that, through this letter, investors can understand the reasons for Risun to outperform the industry in 2022, the reasons for achieving continuous growth, and the logic of achieving growth in 2023.

Risun always insists on enhancing the Company's development momentum through market-driven and investment-driven development, and is striving to help the Company achieve better development through innovation-driven development. Through the combination of different product portfolios, the balance between coke, refined chemicals and the coordinated development of materials, the balance between light and heavy assets, and the balance between oil refined chemicals and coal refined chemicals, the Company has achieved a cycle-through and steady growth. The results of 2022 fully demonstrated the Company's investment value. Risun is striving to become an outstanding Hong Kong listed company and creating greater value for shareholders and investors. The investment of RMB17,000 million in the past four years will continue to improve the Company's profit growth in 2023, 2024 and 2025, hoping that investors can cooperate with the Company in the long run and have stable and sustainable returns. The Company is well aware that investors are not easy to choose stock investment, and it is not easy to obtain continuous and stable returns for investment. The annual profitability and the ability of stable profit growth of Risun have been verified, hoping that everyone can become a strategic investor and long-term investor of the Company.

The value of Risun has been verified in the past four years since its listing. The twenty-eight years of entrepreneurial history is a story of continuous growth and continuous growth, which will continue in the future and become more glorious in the future. We welcome everyone to visit the new building of the headquarters of Risun in Beijing, and the Risun parks in Indonesia and various provinces and cities in China. We look forward to creating good results with our shareholders!

Thank you!

Chairman of China Risun Group

April 17, 2023